Bitcoin Enthusiasm Peaks At $100K, Yet Veteran Eyes A $95K Dip

continued retail demand Bitcoin The $100,000 mark has been attracting attention recently as a sign of investor confidence. However, as short-term holders are driving the current accumulation trend, market watchers warn that the price could drop to $95,000.

Related reading

Retail investors are adding to their holdings at a record pace

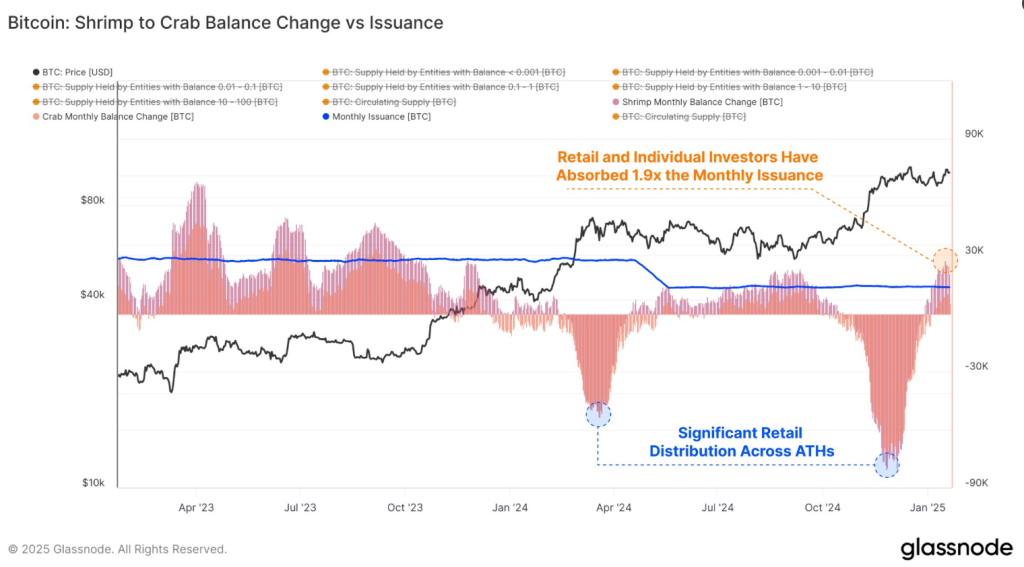

Retail investors, including small shareholders known as “minor shareholders” “Shrimp” and “Crab” Been enthusiastically accumulating Bitcoin. Last month, Glassnode reported that these groups added a total of 25,600 BTC to their portfolios. This is nearly twice the number of newly mined Bitcoins during the same period, indicating the huge demand for “digital gold” at the price peak.

The needs of retail investors #bitcoin Prices still strong around $100,000 – shrimp and crab queue (up to 1 and 10 #BTCrespectively) absorbed 1.9x the newly mined Bitcoin supply last month, totaling +25.6k Bitcoin USD: https://t.co/l0sjVN2Toi pic.twitter.com/UdzcCWXAGo

— glassnode (@glassnode) January 23, 2025

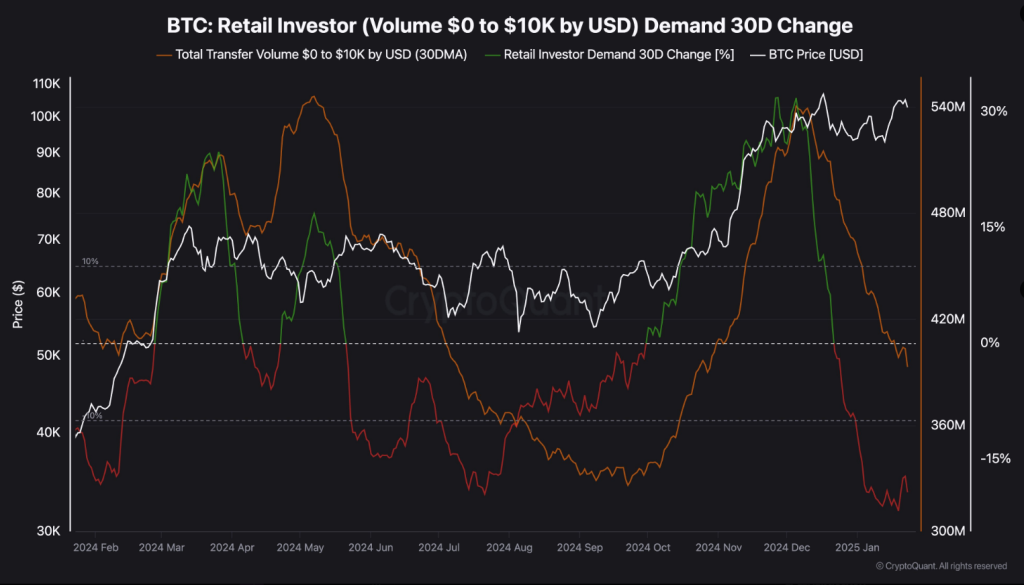

The buying activity by these small investors underscores a broader trend of retail enthusiasm. Still, experts must remain cautious. While this level of accumulation is impressive, the dominance short term holders The surge poses risks to market stability.

Short-term holders pose risk

STH often sells on small dips to secure gains and is known for its quick response to market changes. Especially in the event of unexpected volatility in Bitcoin, this reflexive behavior could trigger higher selling pressure. Market analyst Teddy stressed that the presence of STH could have a significant impact on temporary price fluctuations.

While STH (short-term holders) do absorb a large portion of the newly mined Bitcoin supply, it is crucial to consider the behavioral tendencies of this group. Historically, STH has been more susceptible to panics during smaller market moves, often resulting in… pic.twitter.com/dasfRgjOFR

— Teddy (@TeddyVision) January 23, 2025

Historically, the market has also been more sensitive to downward trends in STH. Analysts believe that amid this general trend, investors should proceed with caution at these levels.

Glassnode: Bitcoin range narrows

Another anomaly seen by Glassnode in Bitcoin price action is the unusually narrow range of moves over the past 60 days. Such events have set a precedent for tumultuous times to come.

This is consistent with historical trends, suggesting that the market will soon experience a breakout or collapse. While sustained price levels of $100,000 reflect optimism, the market’s narrow range adds to an air of unpredictability.

Related reading

Maybe there will be a pullback soon?

Taking all these factors into account, some experts believe that Bitcoin’s price may see a minor correction in the near future. Some experts, including market veteran Michaël van de Poppe, predict that Drop back to $95,000mainly due to selling something in the face of market uncertainty.

Currently, retail demand remains a solid source of support at $100,000. However, investors should be prepared for volatility and keep a close eye on market indicators. As Bitcoin trades near its peak, the interplay of retail optimism and market risks will determine its next move.

At the time of writing, Bitcoin The transaction price was $105,141, The daily and weekly gains were 3.2% and 3.2% respectively.

Featured images from Vecteezy, charts from TradingView