Bitcoin Price Likely To Fluctuate Between $100,000 And $110,000 Until FOMC Meeting, Says Analyst

After a fall to $ 89,256 earlier this month, Bitcoin (BTC) quickly recovered, and reached a new historical high (ATH) $ 108,786 on January 20. However, according to a cryptocurrency analyst, further rise may be restricted, until the Federal Open Market Committee (FOMC) will hold a meeting later this month.

Prior to the Federal Public Marketing Committee (FOMC) meeting

Since November, Donald Trump has won in the U.S. presidential election, the world’s largest cryptocurrency has been in a bullish orbit. In the past three months, BTC has soared from about $ 67,000 to $ 104,536 when writing this article, an increase of more than 50%.

Related reading

However, cryptocurrency analyst Krillin predicts that before the FOMC meeting is held, BTC may continue to “fluctuate” from $ 100,000 to $ 110,000. The analyst said that unless the Bank of Japan adopts unconventional policies and measures, Bitcoin is unlikely to break through the interval before the end of the month.

Currently, CME Fedwatch tools express The Federal Reserve (FED) is likely to cut interest rates at the upcoming meeting of 99.5%. Klin predicts that after the expected eagle meeting, the market will fall, but the press conference of pigeons may partially offset this impact hint Future quantitative loose (QE).

For laymen, quantitative easing is a monetary policy. The central bank injects funds from the economy by purchasing government bonds and other financial assets to reduce interest rates and stimulate economic activities. The increase in currency supply may weaken the legal currency, and it may promote investors to turn assets such as Bitcoin, thereby pushing up their prices to hedge inflation and currency depreciation.

Krillin’s prediction is consistent with the recent market observe The report pointed out that BTC’s profit end has decreased by 93%compared with December, and long -term holders have returned to the holding of holdings to prepare for the next rise. However, how long the current integration stage may last, no one is sure.

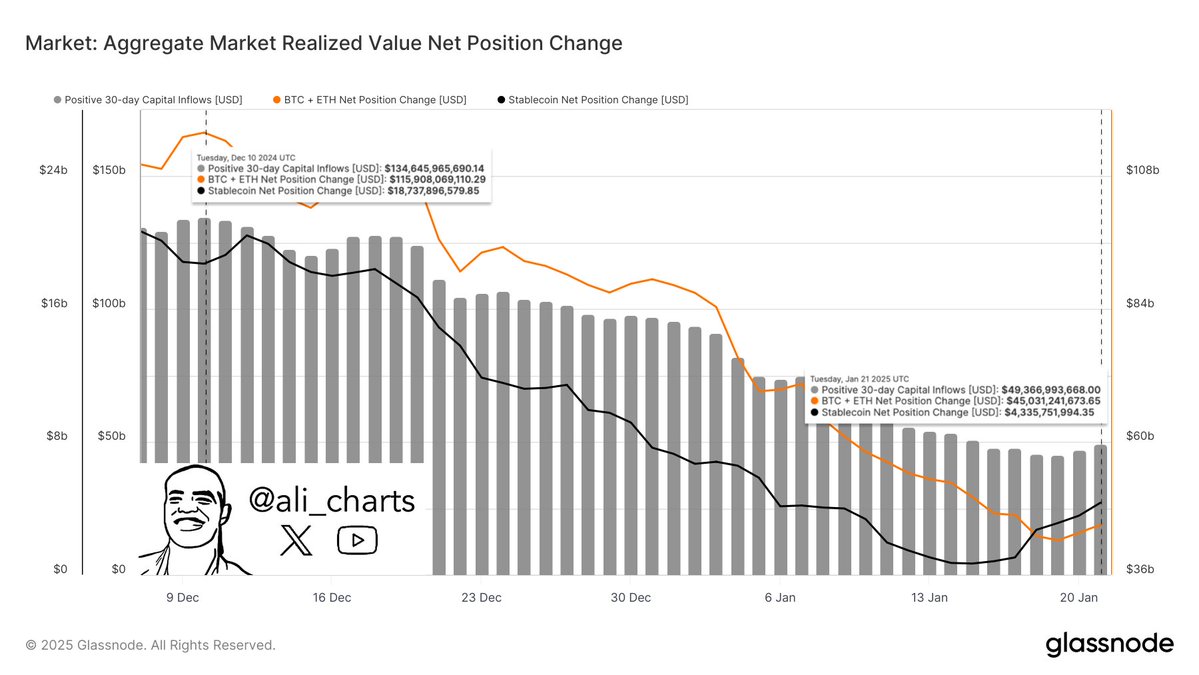

At the same time, cryptocurrency analyst Ali Martinez notes The capital flowing into the digital asset market has dropped sharply from US $ 134 billion on December 10 to $ 43.37 billion. This low liquidity may lead to violent price fluctuations and increase the risk of liquidation of leverage traders.

Will BTC be at the top of 2025?

As the BTC wait for the FOMC meeting to determine its next price trend, some analysts still believe that as more institutions accept the asset under favorable supervision, the cryptocurrency may reach the market cycle in the second quarter of 2025 to the market cycle in the second quarter of 2025 Peak.

Related reading

For example, cryptocurrency analyst Dave The Wave recently Predictive BTC may reach its peak in the summer of 2025. A report of Bitfinex supports this prospect, predict By mid -2025, Bitcoin may soar to $ 200,000, although there will be slight adjustments in the process.

In other words, Bitcoin must defend the price level of $ 100,000, otherwise it may look Assets fell to $ 97,500. As of press time, the BTC transaction price was $ 104,536, up 1.4%in the past 24 hours.

Selected pictures come from unsplash, charts from x and tradingView.com