Is It Time To Give Up On Ethereum Below $4,000? Analyst Weighs The Facts

cryptocurrency analyst Ali Martinez Ethereum’s current price action is discussed, as the second-largest cryptocurrency by market capitalization remains below $4,000. The analyst outlined some facts to provide a clearer picture of whether now is the right time to abandon ETH.

Analysts discuss whether it’s time to abandon Ethereum

in a X postsAri Martinez outlines certain facts to determine whether it’s time to abandon Ethereum. First, analysts noted that ETH has been one of the weakest performing currencies of late, a development that appears to have prompted Vitalik Buterin Change the status quo by changing the leadership team of the Ethereum Foundation.

Related reading

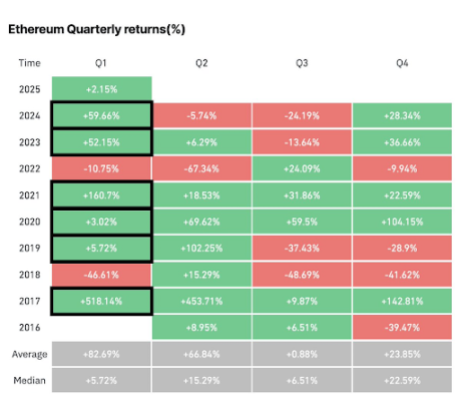

Martinez then mentioned historical data It shows that Ethereum performs well in the first quarter of each year. The analyst has previously suggested that this year is unlikely to be different. At the time, he noted that ETH had its strongest performance in the first quarter, especially in odd years, and that 2025 would be such a year.

Given Ethereum’s positive Q1 performance, Martinez said this could explain why crypto whale Over $1 billion worth of ETH has been accumulated in the past week alone. He previously revealed that these whales purchased more than 330,000 ETH worth more than $1 billion.

Additionally, crypto analysts say buying pressure is also evident Foreign exchange outflowNearly $2 billion in Ethereum has been withdrawn from crypto platforms over the past month. Specifically, 540,000 ETH, worth $1.84 billion, was withdrawn from exchanges in the past month. This accumulation trend is positive as it shows that investors remain bullish on ETH.

However, Martinez mentioned that for Ethereum to achieve a bullish breakout, it must overcome several key resistance levels. From an on-chain perspective, crypto analysts highlight the $3,360 to $3,450 area as main supply wall. This range is the most critical resistance level for ETH, while the key support zone lies between $3,066 and $3,160.

From a technical analysis perspective

Martinez also provided insights into Ethereum price action from a technical analysis perspective. He said that ETH seems to be forming a head and shoulders patternthe collar is $4,000. He added that a decisive break above this level could push the price towards $7,000.

Related reading

The cryptocurrency analyst also revealed that this upside target is consistent with Ethereum 3.2 Market value and realized value (MVRV) pricing range, currently hovering around $7,000. Amid this bullish outlook, Martinez mentioned that a worrying sign is that Ethereum’s network growth has slowed. The number of new ETH addresses is said to have dropped by 9.32%, indicating a decrease in adoption.

Despite this, Martinez believes that the outlook for Ethereum remains bullish. He told market participants to focus on the $2,700 to $3,000 support area. He stated that this demand area must be held to maintain the bullish outlook for ETH.

As of this writing, Ethereum is trading around $3,200, down 4% in the past 24 hours, according to the data data From CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com