Bitcoin Price Plunge Sparks $1 Billion Liquidation Frenzy

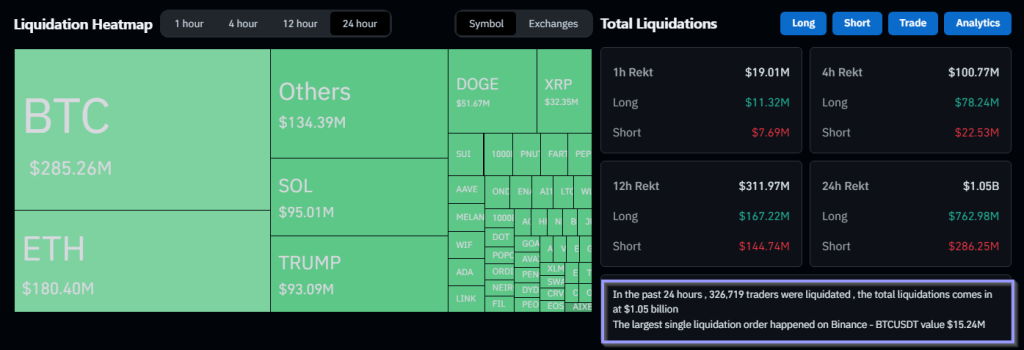

Due to the volatile situation, the cryptocurrency market experienced nearly $1 billion in liquidations in just 24 hours. What are the main drivers? Bitcoin The price dropped significantly below the $100,000 threshold, a figure that previously seemed out of reach to some.

Related reading

The massive wave of liquidations triggered sharp declines in major altcoins, reflecting concerns about market instability that many have been warning about for months.

Massive liquidations occur across the Bitcoin market

Many buyers were not ready for such a rapid decline in Bitcoin prices. When Bitcoin drops, long accounts lose the most and account for a large portion of all liquidations.

According to statistics, about 406,000 traders sold nearly $1.2 billion worth of assets on the last day, including $920 million in long sales and $260 million in short sales. Coin glass.

Many traders were caught off guard by the drop in Bitcoin prices. As Bitcoin fell, long positions suffered the most losses, which significantly increased overall liquidations. Others are not spared cryptocurrency Including Ethereum, Cardano and Dogecoin. As they tracked Bitcoin’s decline, they suffered significant losses.

Cryptocurrency top signs are everywhere.

Still have some nice charts, but regardless, I think we are at the stage of the cycle where it would be prudent to take some chips off the table

— Bluntz (@Bluntz_Capital) January 19, 2025

Bearish trend affects altcoins

Altcoins that have shown promise in the past have also lost value. For example, uncertainty caused the price of XRP to drop significantly, surprising many buyers. Traders were expecting a resurgence in upward momentum, but the sudden drop has left them doubting the stability of the market and the beginning of a longer-term bearish trend.

On X, crypto trader “Bluntz” said “top signs are everywhere.”

“I think we are at a stage in the cycle where it is prudent to give up some leverage,” they added.

Falling prices lead to changing market sentiment

The change in market mentality is very worrying. Panic selling triggered by the risk of additional losses caused the market to become uncertain.

The market correction in 2021 is reminiscent of this sharp crash, when investors quickly liquidated their positions when sentiment suddenly soured. Analysts are now advising investors to remain cautious and monitor market indicators closely before placing bets.

Related reading

Bitcoin hits new ATH

Meanwhile, ahead of Republican Donald Trump’s plans inauguration ceremony Later in the day, Bitcoin (BTC) surged to record high It topped $109,000 during Monday’s Asian trading session. On Binance, the largest cryptocurrency reached $109,335.

In a speech on Sunday, Trump cited the asset’s historic performance in addition to the overall rally in U.S. stocks.

Featured images from WIRED, charts from TradingView