Donald Trump Memecoin Skyrockets Over 12,000% Overnight With $30B Fully Diluted Value – What Happened?

Donald Trump’s official cryptocurrency, Trump Meme Coin, took the crypto world by storm upon its launch. Within a few hours, it became the hottest topic on the market, attracting investors and enthusiasts. By the time America woke up to the news on Saturday morning, Trumpcoin had soared to a staggering $30, a jaw-dropping 12,000% increase from its launch price.

Related reading

The exponential rally that unfolded overnight now appears to be just the beginning. The coin’s rapid rise has had little impact on its increasingly vertical chart. With a staggering market cap of $6 billion and a fully diluted valuation of $30 billion, Trumpcoin is quickly becoming a phenomenon in the memecoin category.

For early investors, the returns are life-changing. A modest investment of $10,000 at launch is now worth an incredible $1.2 million, highlighting The huge potential of this viral asset. As Trumpcoin continues to dominate headlines, there is growing speculation as to whether this is a short-lived hype or the start of a new trend in the cryptocurrency space. With such explosive growth, all eyes are on the next move for this unprecedented meme coin.

Trump becomes the biggest meme coin in history

At 9:44 PM ET, on a quiet Friday night, President-elect Donald Trump made history by launching the $TRUMP meme coin, which has become the largest meme coin phenomenon ever to hit the market. according to Corbesi’s letterTRUMP, the trusted voice in global capital markets commentary, surged 9,500% in just 12 hours after its launch, with trading volume reaching $2.2 billion.

The launch of $TRUMP was initially met with skepticism, but the news later seemed so implausible that many traders believed Trump’s account had been hacked. However, with no official statement refuting the coin’s legitimacy, confidence grew and the price followed.

Related reading

By 12:45 PM ET, Trump had broken through $10, accelerating into a parabolic rally. In early trading, traders witnessed unprecedented returns. One investor reportedly turned $50,000 into nearly $1.1 million in just two hours. Notably, Trump outperformed the S&P 500’s 30-year cumulative return in the same short window.

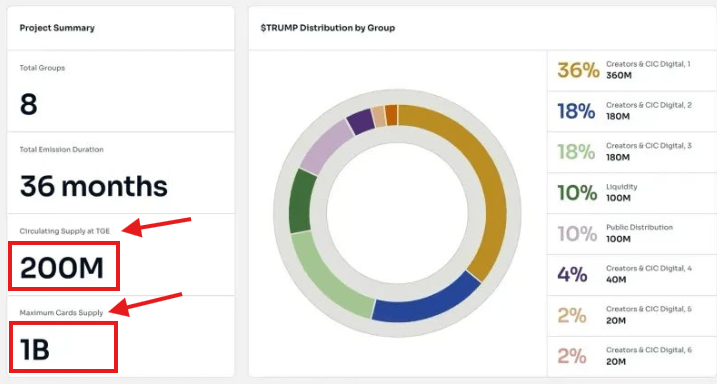

A key factor driving the coin’s explosive price action is its limited circulating supply. Only 20% of the maximum supply (200 million tokens) is currently on the market. Over the next 36 months, the remaining 800 million coins will be gradually released. There is widespread speculation that Trump himself holds the unallocated portion, which could give him substantial control over the asset.

As the Trump Dollar has become a phenomenon, the currency’s trajectory remains a fascinating spectacle. This unprecedented rally and the intrigue surrounding its supply mechanism make it one of the most extraordinary stories in cryptocurrency history.

Price action and market capitalization details

Trumpcoin’s explosive rise has raised questions about its market capitalization and fully diluted valuation (FDV). If all tokens were in circulation, the total supply of FDV would be 1 billion, which would be worth approximately $21 billion based on current prices. However, with only 200 million tokens (20% of the total supply) currently in circulation, the market cap is approximately $4.2 billion. This huge difference highlights the impact of circulating supply on valuation metrics.

Related reading

Currently, price action provides limited insight into the future of the token. There is little data to allow for meaningful technical analysis. The Trump chart essentially consists of parabolic green candles, reflecting his meteoric rise in a hype-dominated environment. This leaves the market with a key question: As the remaining 80% of supply gradually enters circulation, can demand maintain current levels?

Trump’s emissions timeline outlines how to reach maximum supply over the next 36 months. Skeptics believe that this influx of supply could lead to oversaturation, ultimately causing the coin’s price to plummet to $0. Bulls, on the other hand, believe the progressive nature of the timetable allows demand to keep pace. This mitigates the risk of significant price dilution. For now, the debate continues.

Featured image from Dall-E, chart from TradingView