Pocketsmith review | TechRadar

There are many options in the personal finance world when it comes to managing your money. pocket maker is a budget app Not only does this help you do that, but it also eases your pain by helping you plan for the future with a range of features and capabilities personal finance planning.

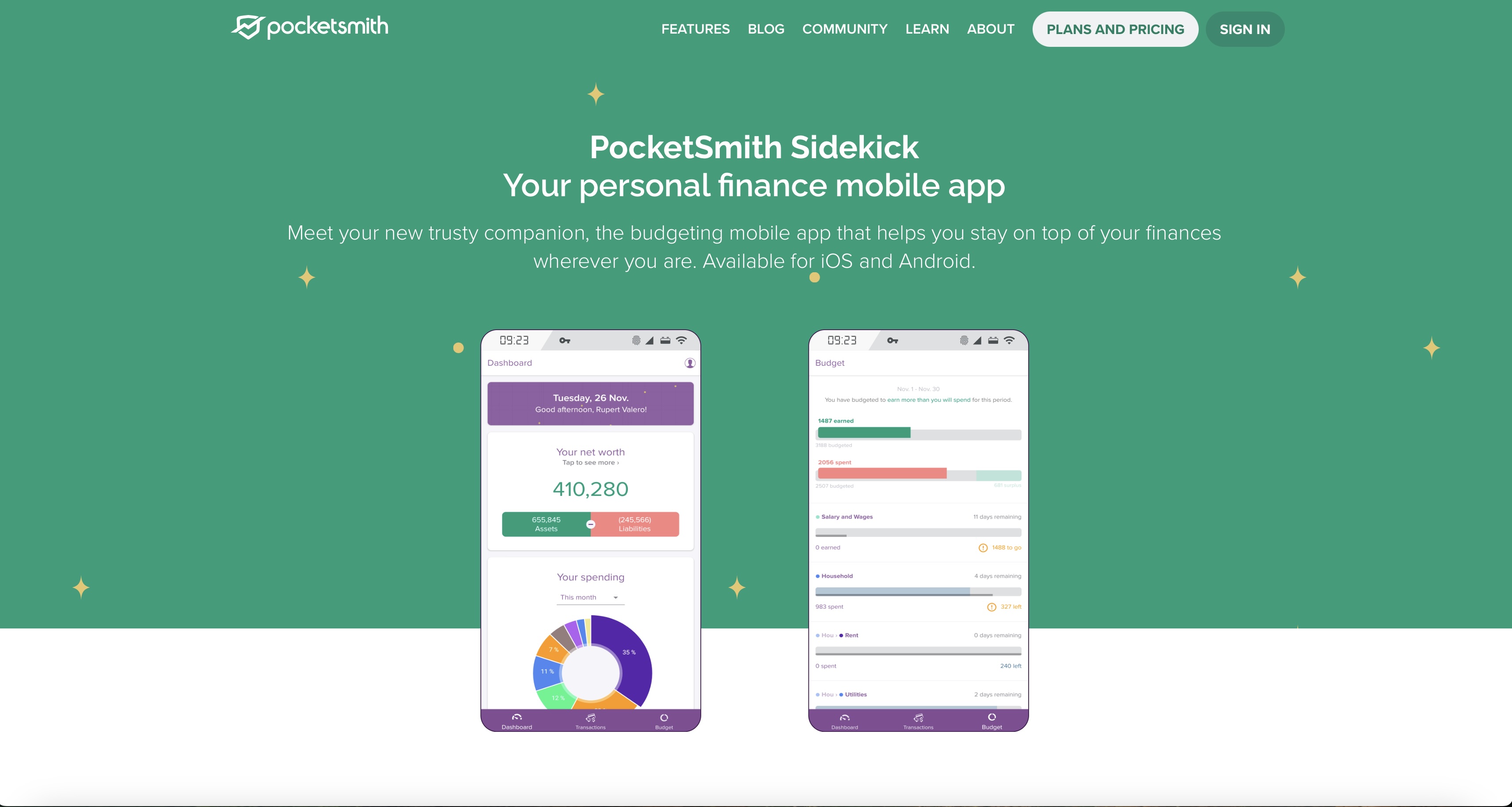

It’s a very desktop-focused app that also has versions for MacOS, Windows, and Linux, but there’s also the option of using it through the app, which is available for iOS and Android. Another appealing aspect of Pocketsmith is that the people behind it have made it very easy to move from another application, such as the much-missed Mint.

Pocketsmith allows users to easily move their accounts, transactions and related categories between Pocketsmith domains. As you’d expect from any decent financial app, it also offers bank-grade 2FA security as well as the option to customize the software to suit your personal needs.

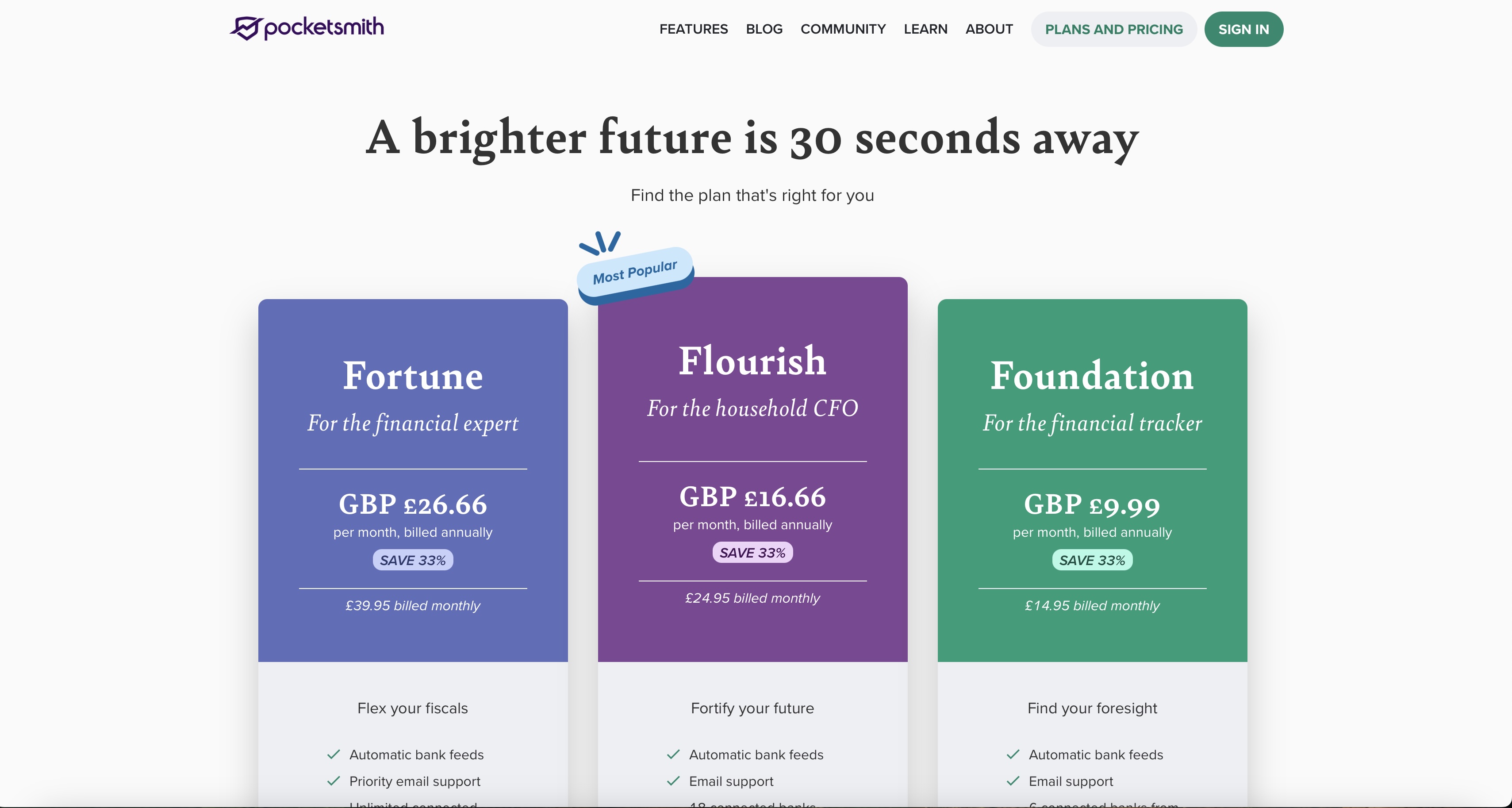

Pocketsmith: Pricing

Currently, there are three different options for using Pocketsmith, in addition to the free version, which is minimalist to say the least. It all starts with the Foundation plan, which costs $119.95 per year and $14.95 per month. Next is Flourish at $199.95 per year and $24.95 per month.

The top of the line is the Wealth package, which costs $319.95 per year, or $39.95 per month. Paying more means Pocketsmith becomes more powerful and allows access to more connected banks. A UK version is also available, with pricing shown above.

Pocketsmith: Features

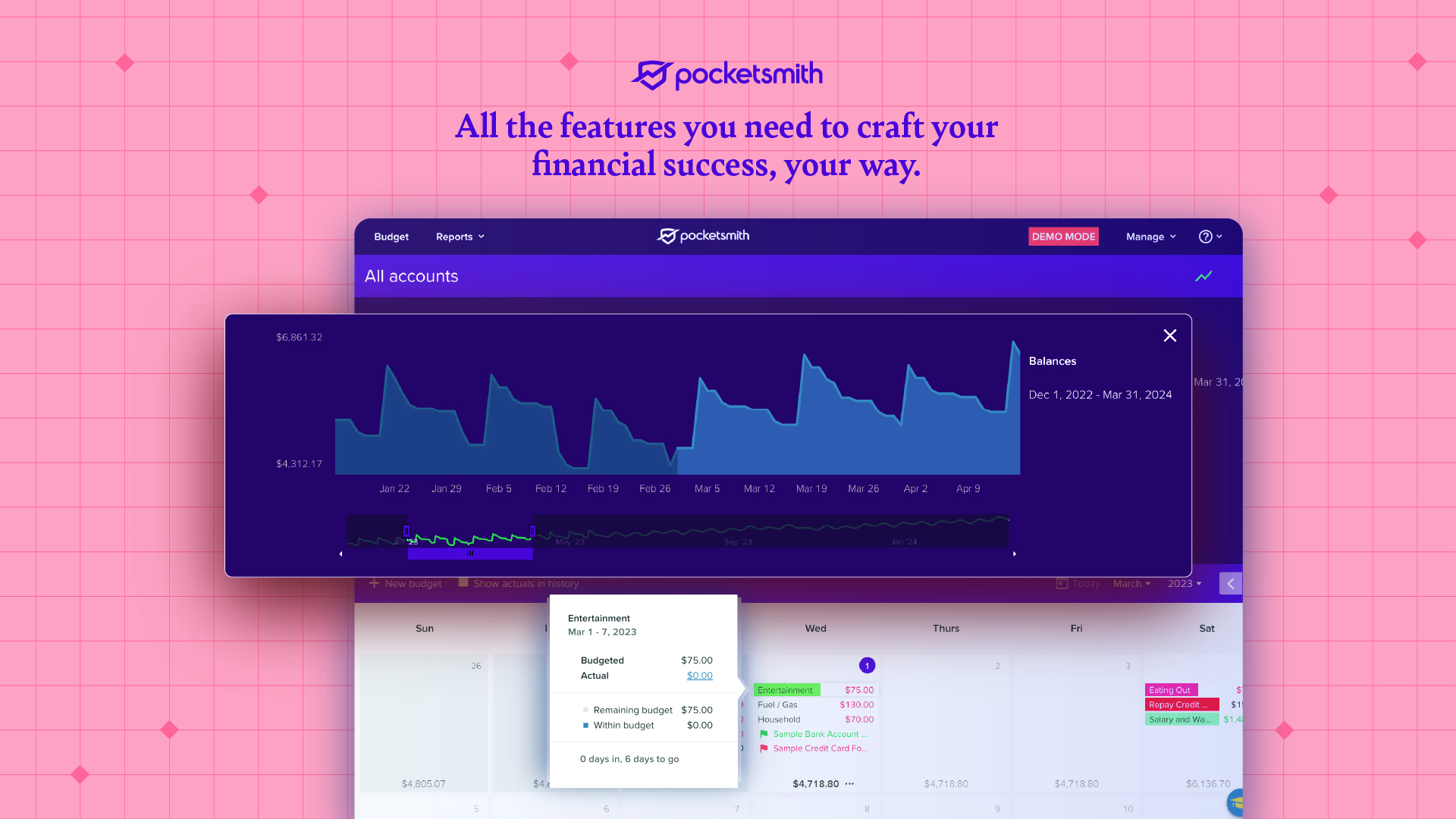

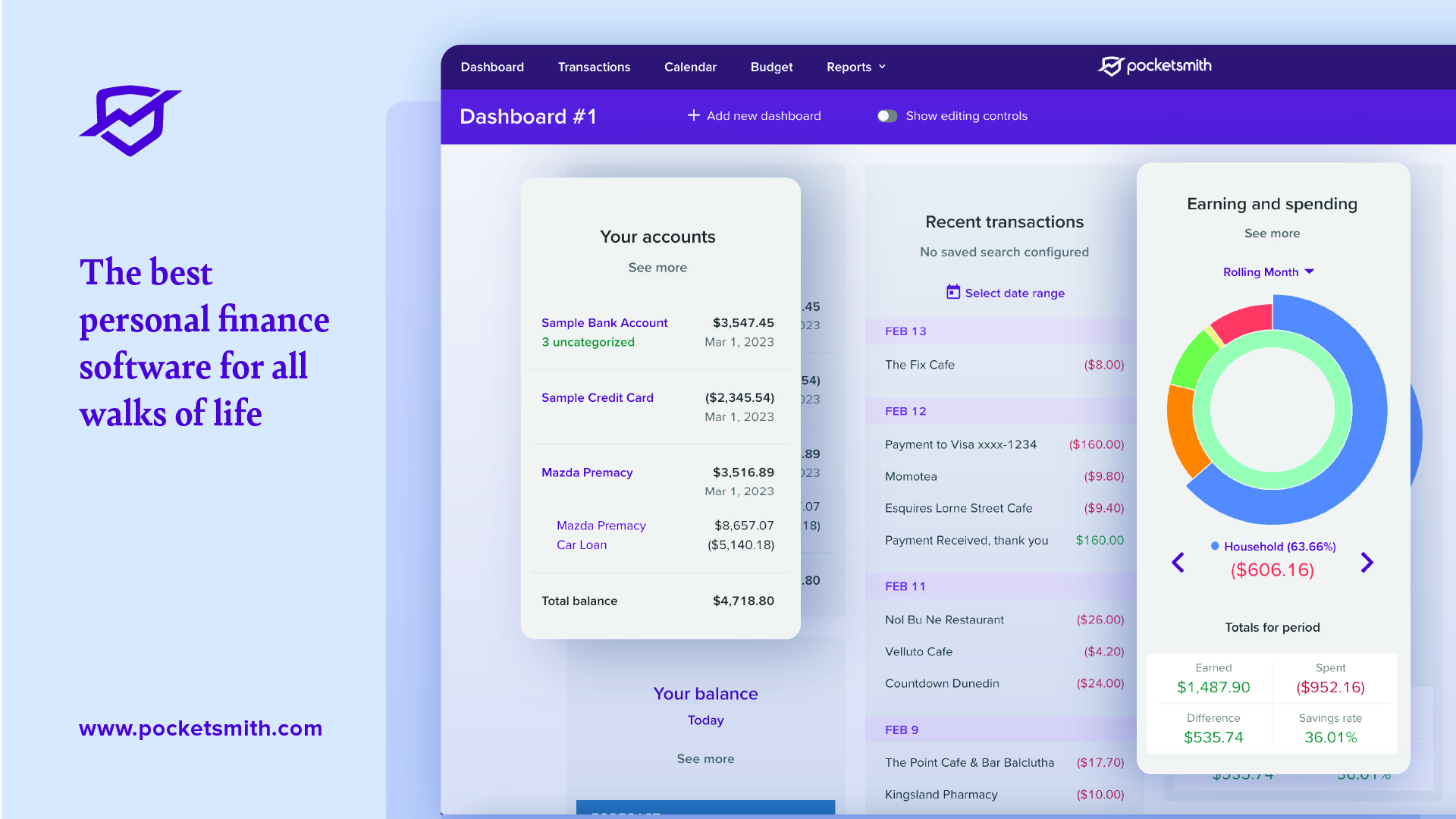

Pocketsmith is full-featured with tons of tools that not only help track spending, but also allow users to keep tabs on their overall spending, plan for the future, and deal with any outstanding debt. When it comes to monitoring your account and related transactions, there are a number of tools at your disposal. Pocketsmith makes it easy to connect to real-time banking information and covers more than 12,000 financial institutions around the world.

This is enhanced by the fact that Pocketsmith can handle multiple currencies and dynamically updates its data based on daily exchange rates for any selected account. Even though this is complicated by multiple accounts and currencies, Pocketsmith allows users to categorize, tag, and annotate any spending to easily track your personal finances.

Pocketsmith also has a range of powerful budgeting and planning tools. The top package generates cash forecasts up to 60 years into the future. Likewise, Pocketsmith makes staying organized easy by giving users the flexibility to schedule upcoming bills and budgets. The app rounds things off nicely with a nice set of reporting tools, which provides a cash flow statement and provides insight into net worth.

Pocketsmith: Performance

Pocketsmith works best in a desktop environment to properly manage all the large amounts of data without the limitations of a small screen. However, despite having a lot to do, these apps perform just as fast as the versions used via a web browser. Pocketsmith has so many different features and capabilities that the designers do a great job of making sure everything works properly, even if you’re making predictions about the future.

Pocketsmith: easy to use

While Pocketsmith has a free version, it’s a very simple version of the software and best avoided if your finances are more nuanced. Once you get to the paid tier, there’s a lot to understand, and a plethora of features and functionality that will take time and patience to master. The interfaces on both desktop and mobile versions are smooth enough, but there’s a lot more to do. The base version makes a lot of sense, but it’s still not exactly a budget version.

Pocket Blacksmith: Support

There seems to be a good community spirit on the Pocketsmith website, with many users keen to share their enjoyment of the personal finance manager. Elsewhere, in terms of proper support, there’s a thick Learning Center with a ton of different articles on how to use the core aspects of Pocketsmith.

These range from the basics, such as getting started, to reporting and net worth topics. If all else fails, there’s a “Contact Us” button for direct support, which initially takes users to a chat-style dialog where questions and queries can be entered.

Pocketsmith: Final Verdict

Pocketsmith isn’t really suitable for people who have a fairly simple personal financial setup and don’t need to deal with a lot of data. However, the free version is very basic, so the real value comes from one of the three paid packages. The downside to these is the fees involved, with premium packages only being a realistic option for wealthy people who have super complex financial problems to solve.