Rachel Reeves’ China trip defended after borrowing cost nerves

public media

public mediaIt is “absolutely right” that Chancellor Rachel Reeves’ trip to China goes ahead as planned, a cabinet colleague has said.

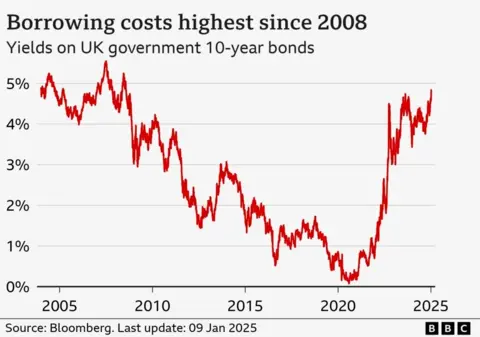

Opposition parties have called on Reeves to cancel a three-day visit aimed at promoting trade and economic ties, After pound hits rock bottom For more than a year, Britain’s borrowing costs have reached their highest level in 16 years.

But Culture Secretary Lisa Nandy said the chancellor should take Britain’s relationship with China, the world’s second-largest economy, seriously.

Nandy said rising borrowing costs were “a global trend we’re seeing impacting economies around the world.”

“We are confident that we will not only take the short-term action to stabilize the economy, but also take the necessary long-term action to get the economy growing again,” she told the BBC.

Rising government borrowing costs have led to fears of further tax hikes or spending cuts as the government tries to comply with its self-imposed rule not to borrow money to fund day-to-day spending.

Lower-than-expected spending on public services could impact areas such as health, education and welfare.

Government bond yields, which have been rising in recent months, climbed again on Friday.

Sterling fell to its lowest level in more than a year on Thursday and also fell at the open.

On Thursday, the Treasury ruled out any emergency intervention in markets, saying they would continue “Orderly operation”.

Joining the Chancellor in visiting China are senior financial figures, including the Governor of the Bank of England and the Chairman of HSBC.

She will meet Chinese Vice Premier He Lifeng in Beijing before flying to Shanghai to hold discussions with British companies operating in China.

The government is seeking to resume annual economic dialogue with China, which has not been held since the pandemic.

Relations between the two countries have become strained in recent years amid growing concerns about the behavior of China’s Communist Party leaders, accusations of Chinese hacking and espionage and China’s imprisonment of pro-democracy figures in Hong Kong.

The Conservatives and Lib Dems criticized the chancellor for going ahead with a planned visit rather than staying in the UK to address the government’s borrowing costs and the falling value of the pound.

Shadow chancellor Mel Stride accused Reeves of being “missing in action”.

However, former chancellor Philip Hammond told World at One on Thursday that he “would not personally advise the chancellor to cancel her trip to China. That could wait until she returns next week.”

Governments often spend more than they collect in taxes, so they often borrow money to fill the gap by selling bonds to investors.

Interest rates, or yields, on government bonds have been rising since around August, a rise that has also affected government bonds in the United States and other countries.

Yields on 10-year bonds have surged to their highest levels since 2008, while yields on 30-year bonds are at their highest since 1998, meaning longer-term borrowing costs for the government are higher.