Greenlight review | TechRadar

It’s never too early to start managing your personal finances, which is why Greenlight is a great idea. It’s a banking app and bank account combo designed to help young users master money management.

unlike some personal finance software and budget appDedicated to helping adults take control of their spending, Greenlight adds a relaxed atmosphere to proceedings that makes taking charge of your money more fun.

In addition to giving children and teens a good foundation in managing their personal finances, Greenlight also offers the option of owning and using a debit card. Giving kids control over their spending habits while allowing parents to keep tabs on their progress is hugely welcome. The Greenlight app regularly gets rave reviews from users and is said to have a user base of over 6.5 million.

While long-time fans of personal finance apps, e.g. accelerate Or Simplifi has been well catered for, making Greenlight available to children and teenagers is a great way to promote education on money matters. In addition to maintaining strong parental controls, Greenlight has managed to keep costs low so far, making it a very affordable option for most families.

Greenlight: Pricing

this Best personal finance software Catering broadly to the adult market, Greenlight is completely tailored to children and teenagers, just like the high-profile GoHenry product. Another bonus in this regard is that Greenlight keeps things simple, with straightforward product selection built around apps and card combinations. You can also try the service for free first.

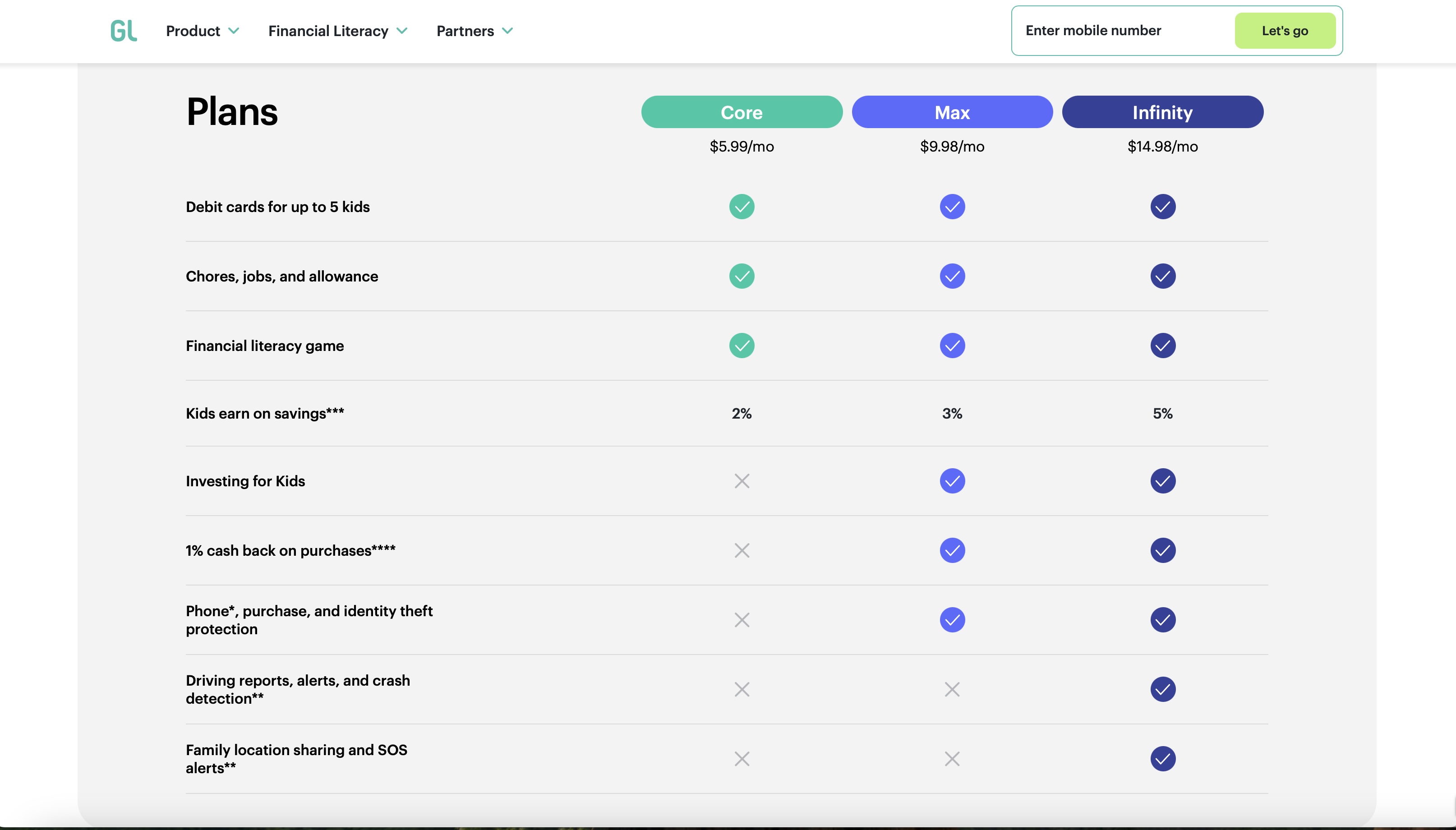

From there, Greenlight offers Greenlight Core, which currently costs $4.99 per month, followed by Greenlight Max, which costs $9.98 per month, and finally Greenlight Infinity. As of this writing, the monthly cost is $14.98.

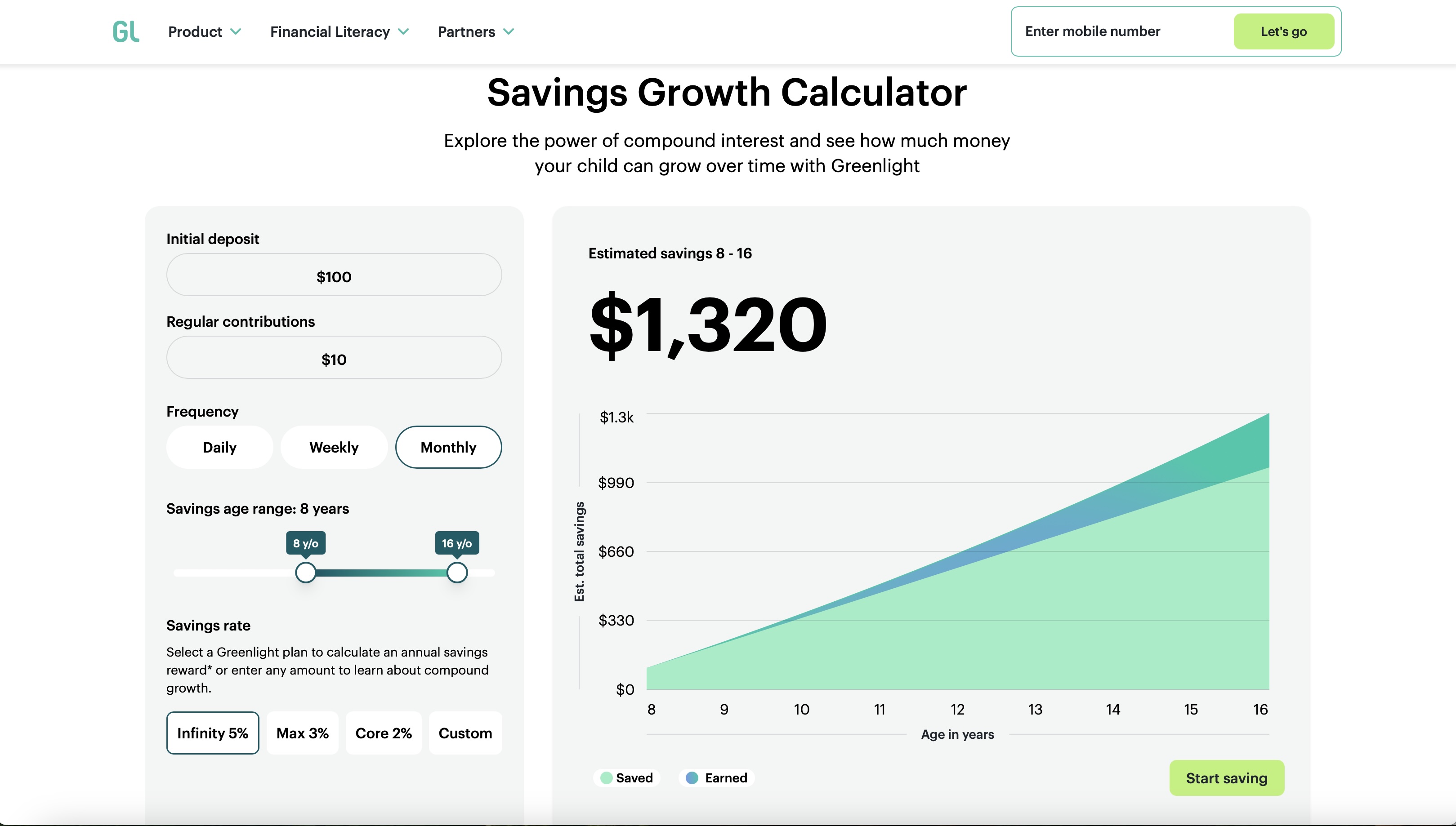

And since these products come with supporting bank accounts, there is interest as well. Currently, the tax rates are 2%, 3% and 5% respectively. But it should be noted that these rates can (and likely will) change based on market conditions.

Greenlight: Features

As is the case with most personal finance software, the pricier packages come with more features and functionality. The centerpiece and mainstay of all the products’ appeal is the debit card that comes with each account, for up to 5 children or teenagers. Adult users of the Greenlight service also have the option of a credit card.

The Greenlight Core package comes with a debit card, a “chores, jobs and allowances” feature and financial literacy games designed to encourage kids to get involved in financial management. The Greenlight Max product builds on that by adding investing for kids, 1% cash back on purchases, and phone, purchase and identity theft protection. Still, it’s worth reading the fine print associated with these features to make sure they’re right for you and your situation.

The Greenlight Infinity product rounds it out with features such as driving reporting, alerts and collision detection options, as well as home location sharing and SOS alerts. The Greenlight website does attach some asterisks to these features, though, so it’s important to check any exclusions or limitations based on what you expect from the product.

Greenlight: Performance

Greenlight works very efficiently, thanks in large part to the neat tools provided by the application itself. There are options to set spending limits and, better yet, schedule chores for the kids. These can be used in default mode or customized to suit more unique scenarios. It’s all very well designed and well thought out, meaning using the app is a breeze for both parents and children.

The great thing about all of this is the way graphics-driven software delivers information. It’s all very simple, well laid out, and with powerful tools like teenagers depositing their salary into the app and making it visible within the app, Greenlight’s performance level is very high indeed.

More advanced features such as the investment aspect of the service are also impressive, with its reassuring line that nothing can be done without the involvement of a parent or guardian.

Green light: easy to use

Greenlight does a great job of providing features and functionality for any parent who wants to keep an eye on things, especially when it comes to their kids’ spending. From the beginning, Greenlight has encouraged children and teenagers to learn how to manage money and use games and other fun features on the app and website. But again, parental controls are at the forefront in all three product variants, so if you’re a parent or guardian, control is never far away.

The same goes for debit cards, as Greenlight Products offers Community Federal Savings Bank products that can be fully supervised by adults. There’s even a cash-back benefit, so young users can quickly learn to appreciate the benefits of smart spending. This is a great way to do things and work in a simple but effective way. Greenlight also offers credit card options for parents if they feel they need more plastic.

Green light: support

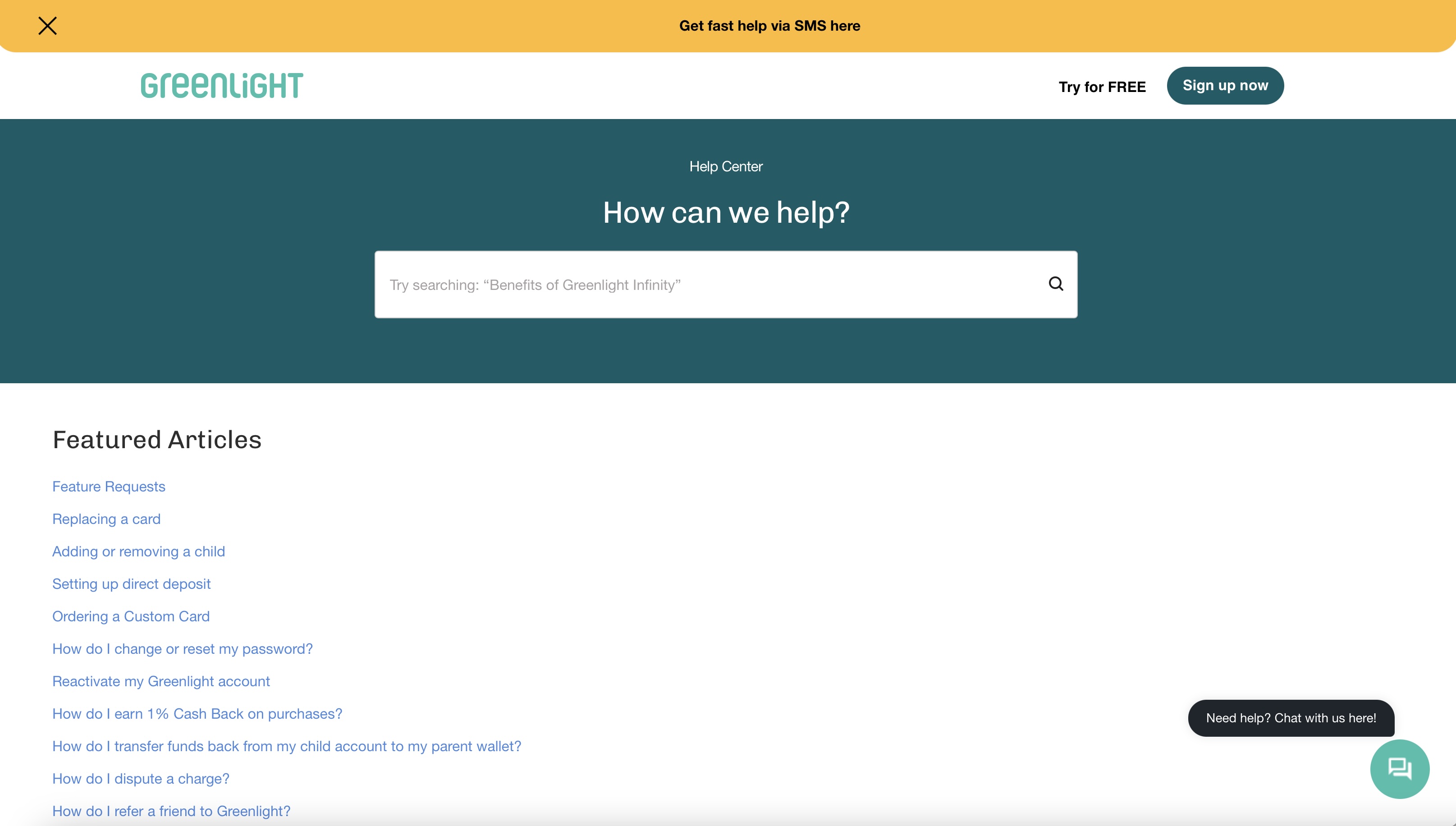

Greenlight works well, but anyone who runs into problems or has questions to ask will find the help portal very useful. There are lots of FAQs here, but there’s also the option of asking questions via text message, and chat tools can also be useful.

At the bottom of the Help Center page, Greenlight also offers more ways to find help, with text numbers, email buttons, and phone numbers available to customers. Obviously, help is available 24 hours a day, 7 days a week, with some changes in holiday hours.

Green Light: Final Verdict

In addition to products like GoHenry, the options offered by Greenlight are also very attractive and perhaps slightly richer. The company offers options right next to Best personal finance software app, but the focus on kids and teens is a coup. The product options are also very practical, providing useful guidance on how to manage money, while also allowing parents to keep a close eye on spending habits.

With three affordable product variants, Greenlight does a great job of making money management fun and interesting. But at the same time, it empowers children and teens to take control of their finances and gives parents options to ensure things never get out of control.