Top Crypto Assets For Q1 2025: Grayscale Reveals Best Altcoins

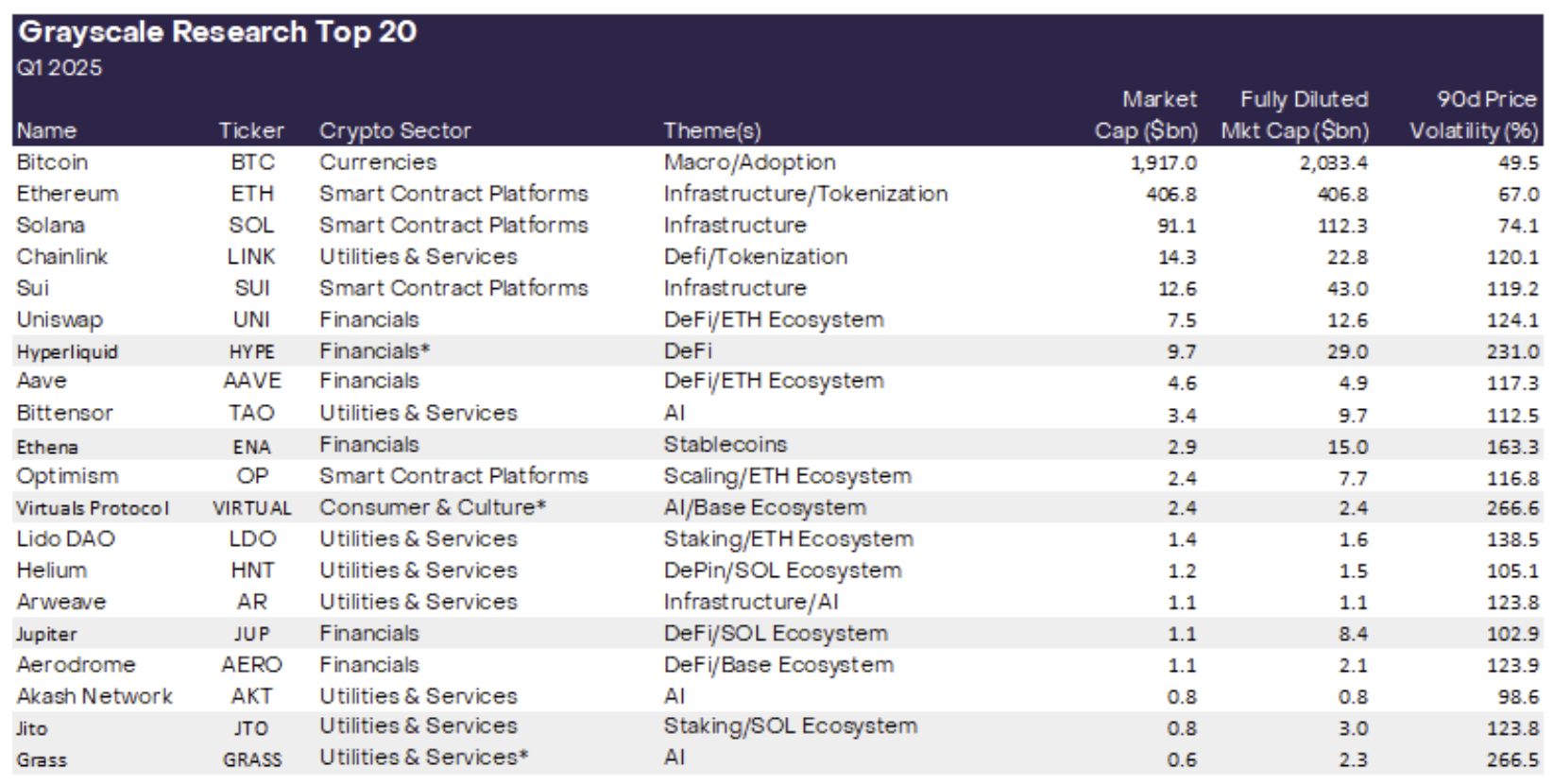

Grayscale Investment has publish Its quarterly review announced the top 20 crypto assets for the first quarter of 2025. Each quarter, the Grayscale research team evaluates “hundreds of digital assets” to guide the rebalancing of the FTSE/Grayscale Crypto Industry Index Series.

In the words of the research report, “Our approach incorporates a range of factors including network growth/adoption, upcoming catalysts, fundamental sustainability, token valuation, token supply inflation and potential tail risks.” The latest additions to the top 20 list are guided by three key market themes that Grayscale believes will shape the coming months: the U.S. election and potential regulatory impact, the rapid development of decentralized AI, and the expanding Solana ecosystem.

Related reading

While Bitcoin, Ethereum, Solana, Chainlink, Uniswap, SushiSwap, Aave, Bittensor, Optimism, Lido DAO, Helium, Arweave, Aerodrome, and Akash Network are still on the list, six new ones were added compared to the previous quarter of altcoins. “We are adding the following six assets to our top 20 asset list for Q1 2025,” the report states, highlighting each project’s notable alignment with one or more of the above themes.

The Best (New) Crypto Assets of Q1 2025

Hyperliquid (HYPE): Layer 1 blockchain for on-chain financial applications, Hyperliquid’s flagship product It is a decentralized exchange (DEX) for perpetual contracts. HYPE is built around a fully on-chain order book and is designed to meet the growing demand for advanced derivatives trading in a decentralized environment. Notably, HYPE has risen rapidly in the past few weeks and has ranked 19th on the list of the largest cryptocurrencies by market capitalization.

Athena (ENA): Ethereum protocol A novel stablecoin, USDe, has been launched, backed by hedging positions in Bitcoin and Ethereum. As Grayscale explains, “Specifically, the protocol holds long positions in Bitcoin and Ethereum, as well as short positions in perpetual futures contracts on the same assets.” The collateralized version of the token leverages both the spot and futures markets. Pricing differences among players have the potential to provide participants with unique benefit profiles.

Virtual protocol (VIRTUAL): The virtual protocol runs on the Ethereum layer 2 network Base, allowing the creation of artificial intelligence agents designed to operate autonomously. “These artificial intelligence agents are designed to mimic human decision-making and perform tasks autonomously,” Grayscale noted. The platform also allows for co-ownership of these agents through tokenization, tying AI capabilities to blockchain infrastructure.

Related reading

Jupiter (JUP): Jupiter has become the leading DEX aggregator on Solana, recording the highest total value locked (TVL) among all Solana applications. The report states that as Solana’s user base expands and speculation around memecoins and AI proxy tokens intensifies, “we believe Jupiter is well-positioned to capitalize on this growing market activity.”

JTO: Jito is a liquidity staking protocol on Solana that has seen widespread adoption over the past year. Notably, Grayscale highlighted the project’s considerable benefits: “Jito has seen significant growth in adoption over the past year and offers one of the best financial profiles of all cryptocurrencies, generating over 550 million in 2024 USD fee income.”

hastily): Grass rewards users by sharing unused internet bandwidth Chrome alloy expand. “This bandwidth is used to scrape online data, which is then sold to artificial intelligence companies and developers for training machine learning models,” Grayscale said. The project enables web scraping by reallocating rewards to users who contribute unused bandwidth Monetization.

Additionally, Grayscale noted that it remains “excited about themes from previous quarters, such as Ethereum scaling solutions, tokenization, and decentralized physical infrastructure (DePIN).” Examples of these established themes include Optimism, Chainlink, and Helium, which remain in the top 20 due to their alignment with scaling, tokenization, and DePIN use cases respectively.

It is worth noting that six assets, NEAR, Stacks, Maker CELO, UMA and TON, have dropped out of the top 20 list this quarter. “Grayscale Research continues to see value in these projects, which remain important parts of the crypto ecosystem. However, we believe the revised top 20 list may provide more compelling risk-adjusted returns for the next quarter, ”Grayscale pointed out.

At press time, HYPE was trading at $29.45.

Featured image created using DALL.E, chart from TradingView.com