Bitcoin Short-Term Holders Fueling Potential Dip – $90K Support Crucial Level To Hold

Bitcoin experienced a highly volatile trading session yesterday, with prices fluctuating between $92,300 and $96,420 throughout the day. The cryptocurrency is currently hovering near the $93,000 mark, making it difficult to establish a clear direction in the short term. As market participants wait for decisive action, there is uncertainty over whether Bitcoin will maintain its bullish structure or face a deeper correction.

Related reading

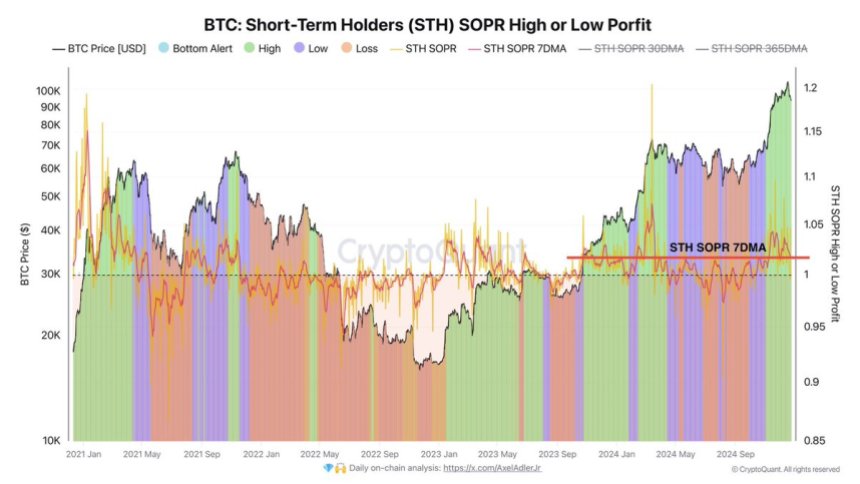

CryptoQuant analyst Axel Adler recently shared valuable insights, highlighting an important trend among short-term holders (STH). Adler said these investors have taken advantage of Bitcoin’s recent rally and continued to sell their tokens at high profits. While profit-taking is a natural part of market cycles, a lack of sustained demand to absorb this selling pressure could challenge Bitcoin’s price stability.

If demand fails to keep pace with aggressive profit-takinga local correction may occur, potentially causing the price of Bitcoin to fall. The delicate balance between profit-taking and market demand makes the next few days crucial in determining Bitcoin’s next move. Will buyers step in to support prices, or will selling pressure lead to a deeper pullback? Investors and analysts are paying close attention to how Bitcoin weathers this critical moment.

Bitcoin demand level response

Bitcoin has experienced a few days of intense volatility as it struggles to break above the psychological $100,000 mark while holding on above the $92,000 support. The market remains in a state of flux, with investors and analysts keeping a close eye on where Bitcoin will go next. Despite the uncertainty, Bitcoin’s resilience at these key levels highlights the ongoing tug-of-war between bullish and bearish forces.

Top Analyst Axel Adler Recently shared an insightful analysis of Xrevealing the behavior of short-term holders (STH). Adler said STH is taking advantage of the recent price surge by aggressively selling its tokens at high profits. While profit-taking is a normal part of the market cycle, a lack of sustained demand to counter this selling pressure could lead to localized corrections and potential price declines.

However, STH is unlikely to continue selling its holdings if prices fall, as selling at a loss during a bull market is generally considered an unwise move. This dynamic could give Bitcoin the breathing space it needs to stabilize at its key support level, currently around the $90,000 mark.

Related reading

If Bitcoin manages to hold above $90,000, a period of consolidation around this level could set the stage for the next rally, potentially pushing BTC to new all-time highs. The next few days will be crucial in determining whether Bitcoin continues its rise or faces a temporary setback.

BTC remains above $90,000

After several days of selling pressure and market uncertainty, Bitcoin is currently trading at $93,800. Despite holding key support at $92,000, a break below the 4-hour 200 moving average (MA) and exponential moving average (EMA) is a short-term bearish signal. These indicators are often viewed as a gauge of market momentum, suggesting that Bitcoin may need additional demand to regain upward momentum.

For bulls to regain control and spark a fresh rally, Bitcoin must regain these key levels. The 4-hour 200 SMA at $96,500 and the 4-hour 200 SMA at $98,500 are important obstacles. A successful break above these thresholds and securing a close above them would confirm renewed bullish momentum.

Related reading

If Bitcoin achieves this feat, it could set the stage for a massive rally in price discovery, breaking through psychological barriers like $100,000 and paving the way to new all-time highs. On the other hand, failure to retrace these indicators could signal a continuation of the consolidation or a possible retest of lower support.

Featured image from Dall-E, chart from TradingView