What Lies Ahead For ETH?

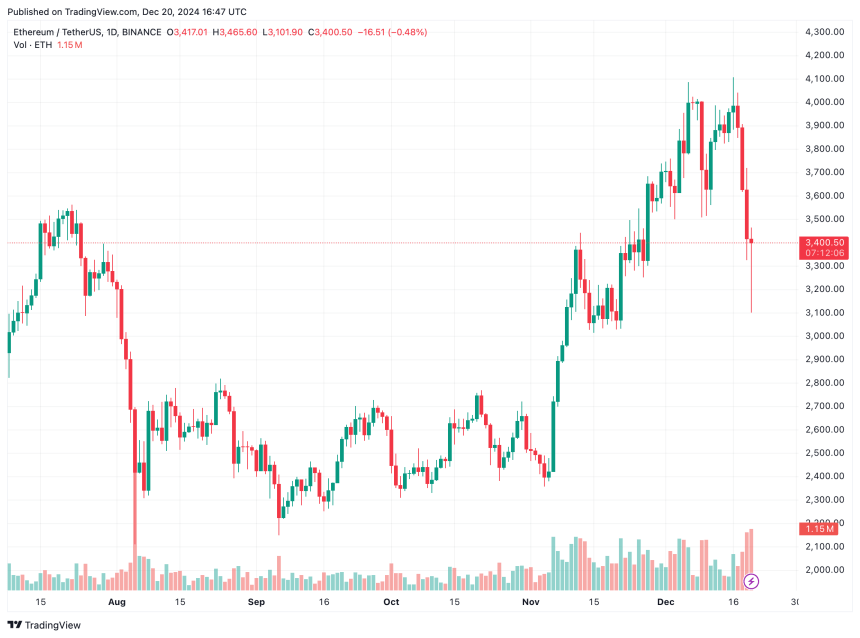

Ethereum (ETH) has faced rejection of the key $4,000 resistance level three times since March 2024 as a result of yesterday’s cryptocurrency market plunge. The second-largest cryptocurrency by reported market capitalization is currently trading at $3,400 levels, down 6.7% from 2024 levels. Past 24 hours.

What’s behind Ethereum’s poor price performance?

While ETH is up a respectable 47% year-to-date (YTD), its growth has been outpaced by other major cryptocurrencies such as Bitcoin (BTC), Solana (SOL), and XRP, which have posted significantly higher returns over the same period . There are several factors that appear to be holding back Ethereum’s price momentum.

Related reading

One of the contributing factors is Ethereum’s relatively weak brand recognition relative to Bitcoin. This is emphasized by the lackluster In response to the launch of a spot ETH exchange-traded fund (ETF) in August. The launch of these ETFs failed to bring any meaningful price movement to ETH.

data This further reveals significant differences in investor interest between the two assets. The total net assets currently held in the U.S. spot ETH ETF are $11.98 billion. In comparison, the spot BTC ETF holds $109.66 billion, almost ten times that amount.

In addition, spot ETH ETF outflows exceeded $60 million yesterday, setting the largest single-day outflow since November 19. Cryptocurrency analyst Ali Martinez noted that social sentiment surrounding ETH has achieve The lowest point in a year. However, based on historical trends, this may paradoxically signal a bullish opportunity for Ethereum.

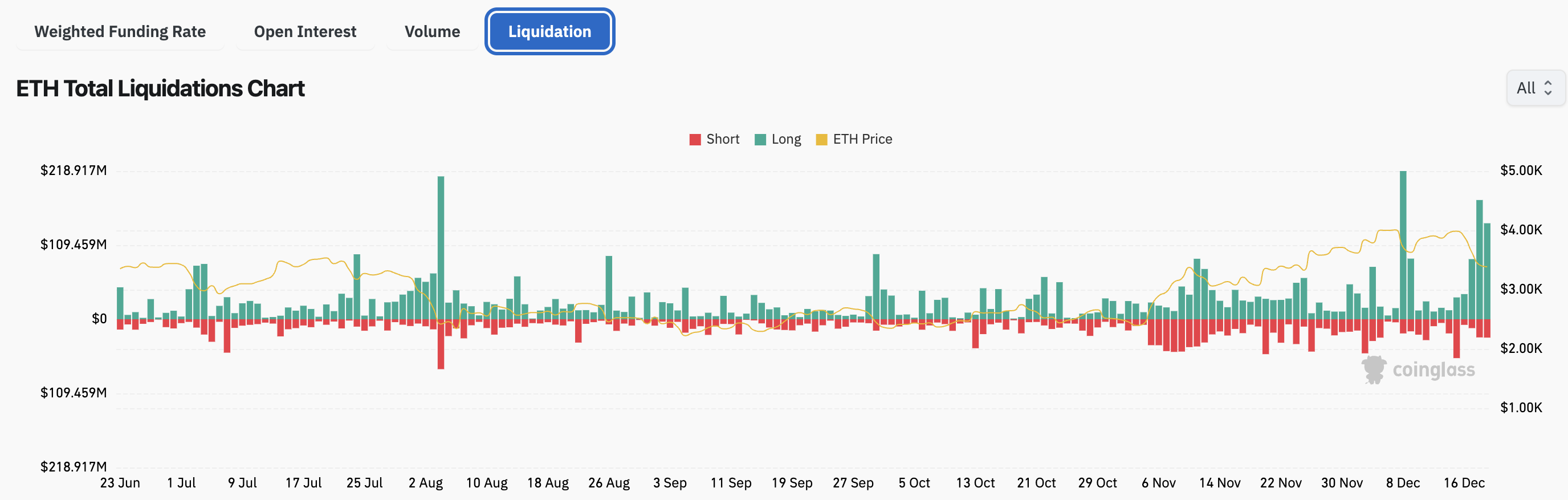

Futures traders have also become bearish on ETH as the total premium on futures positions turned negative for the first time since November 6. The market downturn triggered Ethereum’s largest liquidation event since December 9, with $299 million liquidated in a single day. Liquidations of this magnitude often result in cascading selling and increased price volatility.

Another recurring concern stems from the Ethereum Foundation’s tendency to sell ETH near local price peaks. in the last X postalLookonchain noted that the Ethereum Foundation sold 100 ETH on December 17. Following the sale, the price of ETH fell by approximately 17%.

There are further doubts about Ethereum’s supply. Recent Binance Research Reports Highlight ETH’s relatively high issuance rate raises questions about its “ultrasonic currency” narrative, suggesting that Ethereum is a deflationary asset.

Is Ethereum about to rebound?

Experienced cryptocurrency analyst @Trader_XO point out They purchased spot ETH yesterday at the $3,200 price level. The analyst added that they expect prices to experience “several weeks” of consolidation before ETH’s next leg up.

Related reading

Meanwhile, cryptocurrency trader @CryptoShadowOff spotted a potential ascending triangle pattern on the ETH monthly chart. According to their analysis, ETH may fall further to the $2,800 range aim A new all-time high (ATH).

Market Analyst @CryptoBullet1 emphasize Looking at the 4-hour chart, ETH has not been this oversold since August 5, indicating that a rebound may be imminent. At press time, ETH was trading at $3,400, down 6% in the past 24 hours.

Featured images from Unsplash, charts from Coinglass, X and Tradingview.com