Bitcoin Realized Losses Spike 3 Times The Weekly Average – Healthy Correction Or Downturn?

Bitcoin faces its first major correction since early November, falling 13% from its all-time high of $108,364. This sudden pullback sent shockwaves throughout the cryptocurrency market, shifting sentiment from extreme bullishness to uncertainty and even fear. The sell-off has been particularly brutal for altcoins, many of which are bleeding heavily as Bitcoin struggles to regain momentum.

Related reading

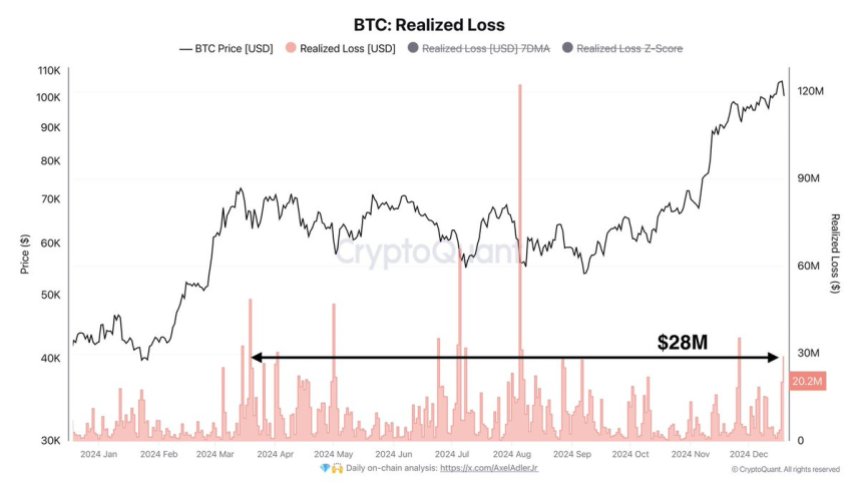

CryptoQuant’s key metrics underline the seriousness of the situation, with realized losses totaling $28.9 million, a staggering 3.2x higher than the weekly average. The surge in realized losses suggests some investors are exiting positions as the market recalibrates after weeks of sharp gains.

The big question now is whether this is just a healthy correction in a bullish trend or the start of a larger downtrend. Traders pay close attention Bitcoin’s Ability to Hold Key Support Levels and the behavior of altcoins, which often amplifies Bitcoin price movements.

For now, the market remains at a crossroads, and the coming days may reveal whether Bitcoin is able to recover and resume its uptrend, or whether this correction signals a longer period of weakness.

Bitcoin faces selling pressure

After two days of aggressive bearish activity, Bitcoin is facing significant selling pressure, marking a critical moment for the market. The sudden shift in sentiment has caused many analysts and investors to become cautious, with some turning bearish as Bitcoin’s recent trend begins to lose momentum. The correction has the market questioning whether current price action is a natural pause or a precursor to deeper losses.

top analyst Axel Adler recently shared insights about Xbacked by compelling on-chain data, highlights that realized losses have surged to $28.9 million. The figure was 3.2 times the weekly average, indicating intensified selling activity. Adler’s analysis highlights that while the sell-off may seem concerning, it is consistent with a healthy market correction, especially after Bitcoin’s significant rally to $108,300.

Adler noted that the current decline should not trigger panic but should instead lead to a period of patience for long-term holders. He emphasized that now is the time to hold unless additional bearish signals emerge that suggest the downtrend will continue for longer. Corrections like this often give the market the momentum it needs for the next leg higher, as weak hands exit and strong hands strategically position themselves.

Related reading

Price action remains crucial, with investors watching closely to determine whether this correction sets up a solid foundation for future growth or signals further declines.

BTC Holds Bullish Structure (Currently)

Bitcoin is currently trading at $94,400 after three consecutive days of heavy selling pressure. Despite the clearly bearish sentiment in the market, BTC managed to hold above the key support level of $92,000. This support is crucial as it clearly defines an ongoing uptrend. Staying above this level shows resilience and sets the stage for a potentially strong rebound if buyers regain control in the coming sessions.

While recent price action reflects uncertainty, the decline is not as severe as market sentiment would suggest. Negative sentiment has prompted many traders to take a cautious stance, but BTC’s ability to remain above $92,000 shows the underlying strength of the market structure.

Related reading

However, sentiment remains a key market driver. Restoring confidence is crucial for Bitcoin to return to higher levels and resume bullish momentum. If sentiment does not improve and prices continue to fall, a deeper correction is more likely. Losing support at $92,000 could pave the way for a retest of lower levels, which could lead to further volatility.

Featured image from Dall-E, chart from TradingView