Bitcoin Data Reveals No Significant Panic Selling In The Market – Shakeout Or Trend Shift?

Bitcoin faced a sharp correction yesterday, falling 8% from its all-time high of $108,300, after the Federal Reserve announced a 25 basis point interest rate cut and revised policy indicating smaller rate cuts in 2025. Despite the decline, Bitcoin managed to remain above $98,000. A key liquidity level that analysts are watching closely.

Related reading

The recent price action raises a key question: Is this the beginning of a more significant correction, or is it just a shock that will drive the next phase of Bitcoin’s rally? CryptoQuant analyst Axel Adler provided important insight, noting that there was no significant panic selling in the market, indicating that investor confidence is currently intact.

Bitcoin’s Resilience at Current Levels A sign that markets are recalibrating in light of the Fed’s latest moves. As traders and investors digest these developments, all eyes are on whether Bitcoin can regain momentum and push back to its previous highs, or if a deeper pullback is imminent. With market sentiment hanging in the balance, the next few days will be crucial in determining Bitcoin’s next direction.

Bitcoin remains strong

Despite recent losses and a clear change in market sentiment, Bitcoin remains resilient above key liquidity levels, maintaining its long-term bullish structure. The market’s reaction to the Federal Reserve’s policy statement triggered price declines and raised concerns, but Bitcoin’s ability to hold on to key support highlighted its underlying strength.

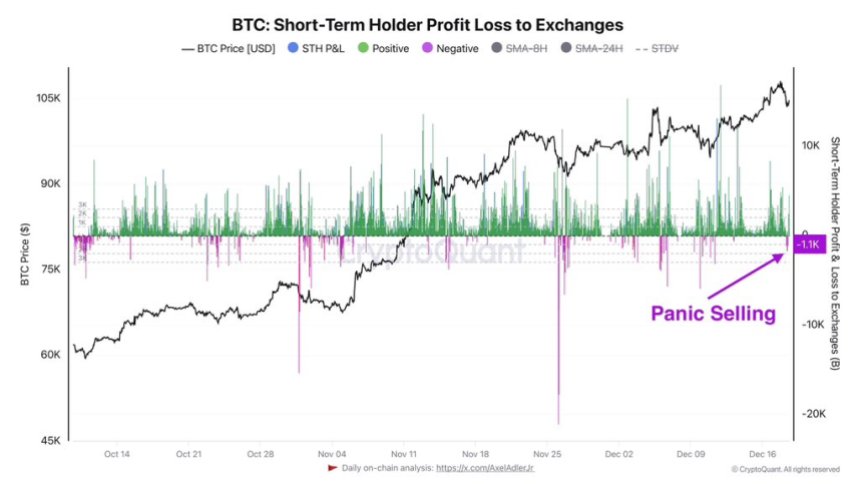

CryptoQuant Top Analyst Axel Adler Data recently shared on Xrevealing the current dynamics of the market. Adler said that even after Bitcoin’s sharp decline, there was no obvious panic selling.

He highlighted a chart tracking short-term BTC holders losing money to exchange profits, showing that the metric is now at higher levels than during the sell-off event in early December. This suggests that the recent sell-off may be less fear-driven and more of a strategic adjustment.

This shock could create liquidity and provide the necessary impetus for Bitcoin’s continued rise. However, he also warned that this could mark the beginning of a broader correction that could take time to fully develop.

Related reading

The next few weeks will be crucial for Bitcoin. As the market stabilizes, traders and investors are watching to see if Bitcoin can recover to higher levels or if it may consolidate further to the downside.

Price Action: Technical Levels to Hold

Bitcoin is currently trading at $101,800, having successfully tested local demand at $98,695 earlier today. The price structure remains unchanged, with Bitcoin forming a clear pattern of higher highs and higher lows, signaling continued bullish momentum. Despite recent volatility, market sentiment continues to remain positive as Bitcoin remains above key support levels.

For Bitcoin to maintain its upward trajectory, it must decisively break above $103,600. This level was an important pivot point last week and marked a key area for buyers and sellers. A break above this resistance could signal new momentum, setting the stage for further gains as Bitcoin reaches new highs.

However, failure to move above $103,600 could lead to a shift in market sentiment. If BTC also loses the psychological level of $100,000, the start of a broader correction could be confirmed. This scenario could push prices towards lower support areas as the market recalibrates.

Related reading

The next few days will be crucial in determining Bitcoin’s near-term direction. Traders are keeping a close eye on the $103,600 resistance and $100,000 support as these thresholds will determine whether BTC continues its rise or enters a correction phase.

Featured image from Dall-E, chart from TradingView