What It Means For BTC Price?

Amid its historic price action, Bitcoin (BTC) quietly hit a new all-time high (ATH) against gold. Veteran trader Peter Brandt highlighted this insight in an X post.

Bitcoin hits new highs against gold: Room for further growth?

Brandt’s analyze It was revealed that the BTC to gold ratio has reached a new ATH of 32.19 ounces of gold per BTC. In his post, the veteran trader also took a subtle dig at longtime gold advocate and outspoken Bitcoin critic Peter Schiff.

Related reading

For those unfamiliar, the Bitcoin to Gold ratio measures the performance of Bitcoin relative to gold, showing how many ounces of gold it would take to purchase one entire Bitcoin. This metric highlights Bitcoin’s growing dominance as a store of value.

Brandt further noted that Bitcoin’s next target is 89 ounces of gold per BTC, indicating that Bitcoin has plenty of room to grow against the precious metal. This is consistent with broader claims within the crypto industry that Bitcoin is on the verge of challenging gold’s $15 trillion market capitalization.

It is worth recalling that before Brandt Predictive By 2025, the price of Bitcoin will increase by 400% relative to gold. Back in October, he predicted that BTC could be worth 123 ounces of gold based on historical market patterns.

A recent report from Bernstein Trading further corroborates this statement, predict Bitcoin is expected to replace gold as the safe-haven asset of choice within the next 10 years. As of now, the market value of BTC has reached US$2.11 trillion, steadily approaching gold’s dominance.

Eric Voorhees, one of the earliest Bitcoin advocates, made a similar prediction. The CEO of ShapeShift cryptocurrency exchange made a bold prediction, explain Unlike gold or oil, Bitcoin’s digitally programmed scarcity of supply will drive its price higher.

In addition, ETF Store President Nate Geraci, predict Total assets under management of Bitcoin-based exchange-traded funds (ETFs) could exceed that of gold ETFs within the next two years. To support this view, data Data from SoSoValue shows that the cumulative net inflow of all spot BTC ETFs is currently US$35.6 billion, while the cumulative net inflow of gold ETFs is US$55 billion.

Impact of potential Bitcoin strategic reserves

As BTC breaks through the key price level of $100,000, speculation is growing about President-elect Donald Trump’s attitude towards digital assets. Industry experts believe Trump may prioritize Bitcoin adoption early in his second term, further pushing the price of Bitcoin higher.

Related reading

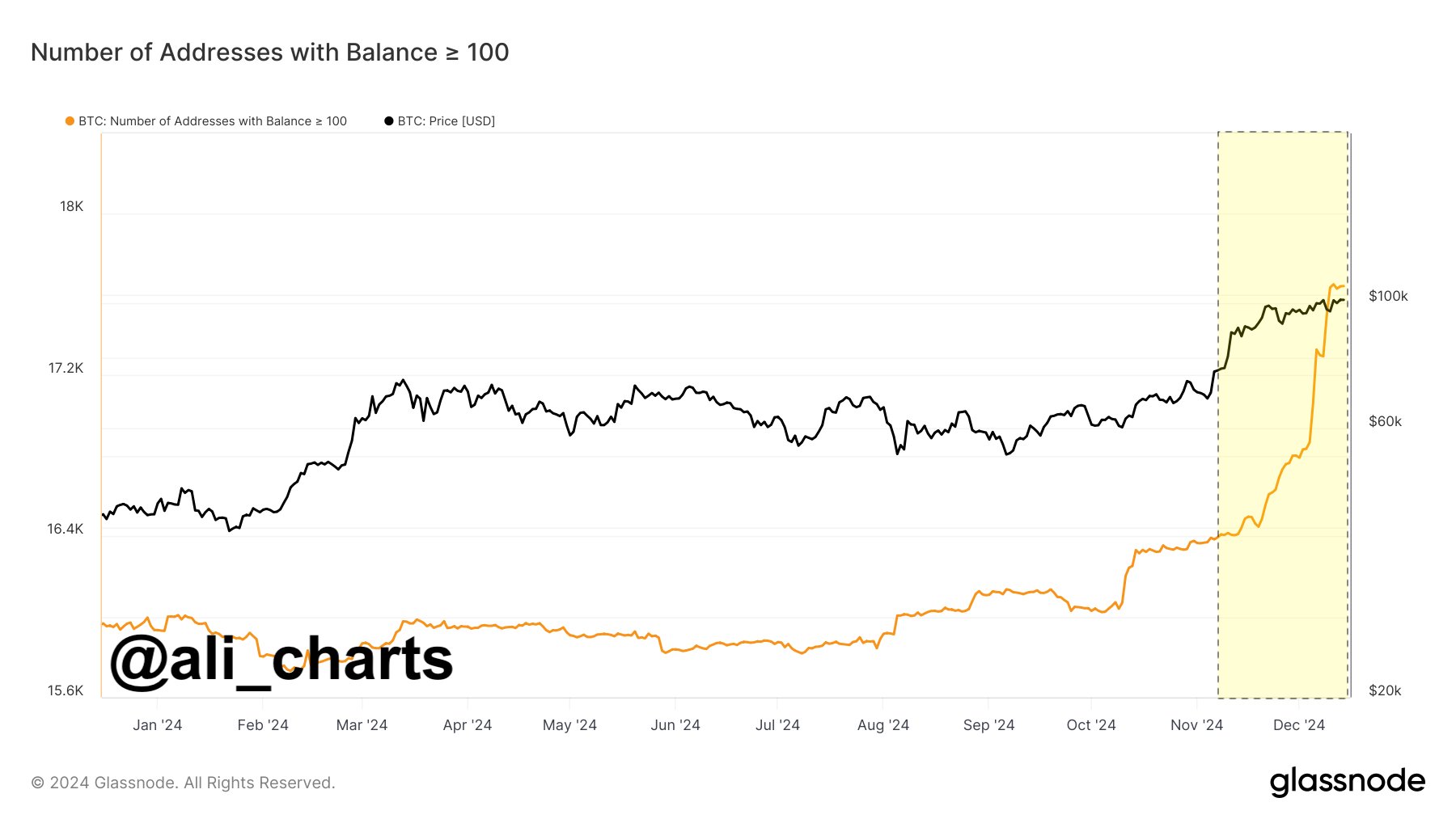

The data supports this optimistic view. According to cryptocurrency analyst Ali Martinez, the number of BTC whales (wallet addresses holding more than 1,000 BTC) has skyrocketed since Trump’s election.

This optimism was further fueled by guess Around the potential strategic reserve of Bitcoin in the United States. famous financier debate If the United States builds such reserves, China and other countries may follow suit to remain competitive. As of press time, BTC is trading at $106,909, up 3.7% in the past 24 hours.

Featured images from Unsplash, charts from X and TradingView.com