Bitcoin Top Here? What Historical HODLer Selloff Pattern Says

On-chain data shows long-term Bitcoin holders are selling. This is whether the current level of selling is enough to reach a price top.

Long-term Bitcoin holders have been selling heavily of late

in a new postal On X, analyst Ali Martinez discusses the historical trend of long-term holders relative to Bitcoin top holdings. this”long term holders(LTH) refers to BTC investors who hold Bitcoin for more than 155 days.

LTH represents one of the two main segments of the BTC market based on holding time, the other group is known as Short Term Holders (STH).

Historically, the latter has proven capable of containing the weak hands of the market, while the former consists of holders who have little reaction to price increases and plunges.

So a sell-off from STH usually doesn’t make sense, but a sell-off from LTH might be worth noting since it’s not a particularly common event. One way to track the behavior of diamond hands is through their net position changes.

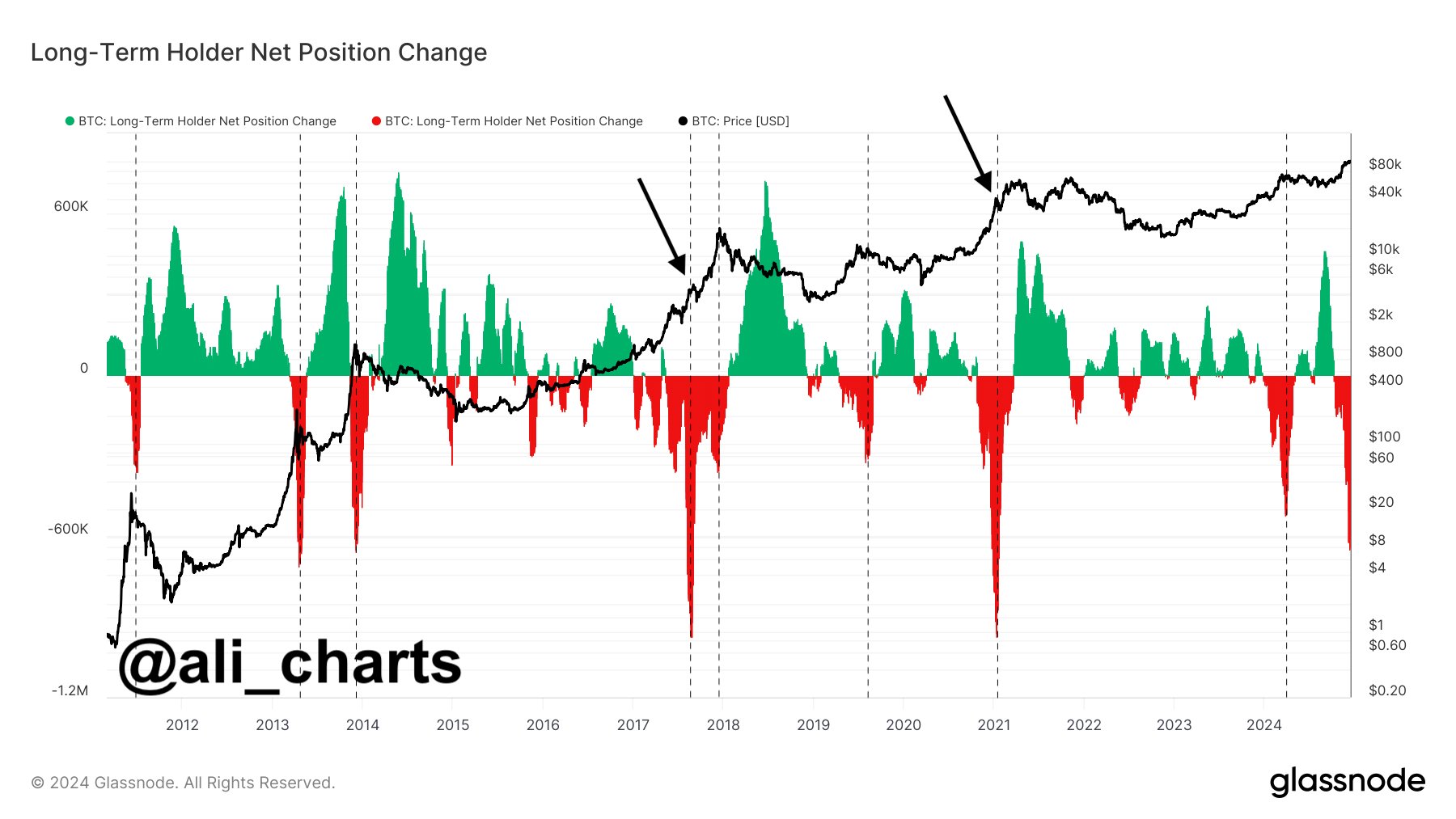

Net Position Change is an on-chain metric that measures the total amount of Bitcoin entering or exiting the LTH queue. Below is a chart of indicators shared by analysts showing trends in the cryptocurrency’s value throughout history.

As shown in the chart above, Bitcoin LTH net position changes have dropped sharply into negative territory in recent weeks, meaning that net supply has left the group.

This is not the first time this indicator has shown this trend this year, as a similar pattern was observed in the first quarter of this year. In the chart, Martinez highlights this and other earlier instances of this trend occurring.

Big sell-offs in LTH often seem to coincide with some sort of top in the cryptocurrency. “Interestingly, in 2017 and 2021, their biggest sell-offs occurred before the last leg up,” the analyst noted.

So if something similar is going to happen with the current bull market, the current LTH sell-off may actually be just the beginning of an eventual rise that will lead to cyclical top For Bitcoin.

The indicator is also currently not as negative as it was during the bull market’s biggest red peaks in 2017 and 2021, which could be another sign that the top is not yet in sight. However, it remains to be seen whether the same pattern will be repeated this time.

bitcoin price

Bitcoin is back in all-time high (ATH) discovery mode, with the price just setting a new record above the $107,000 milestone.