Bitcoin Miners Now In Selling Mode For A Year: Should You Be Concerned?

On-chain data shows that Bitcoin miners have been selling off for about a year. Here are their sales to date.

Bitcoin miners sold more than 4% of assets last year

As CryptoQuant community analyst Maartunn points out in a new report postal On Day X, BTC miners were in net selling mode for quite some time. The correlation on-chain indicator here is “miners reserve”, which records the total number of tokens currently held by miners in their wallets.

Related reading

When the value of this metric rises, it means that chain validators are adding a net amount of tokens to their total holdings. This trend may indicate that this group is accumulationwhich is naturally beneficial to asset prices.

On the other hand, the observed declining indicators indicate that miners are withdrawing coins from their addresses. The main reason why the gang conducts such transactions is for sell-off related purposes, so this trend could have a bearish impact on BTC.

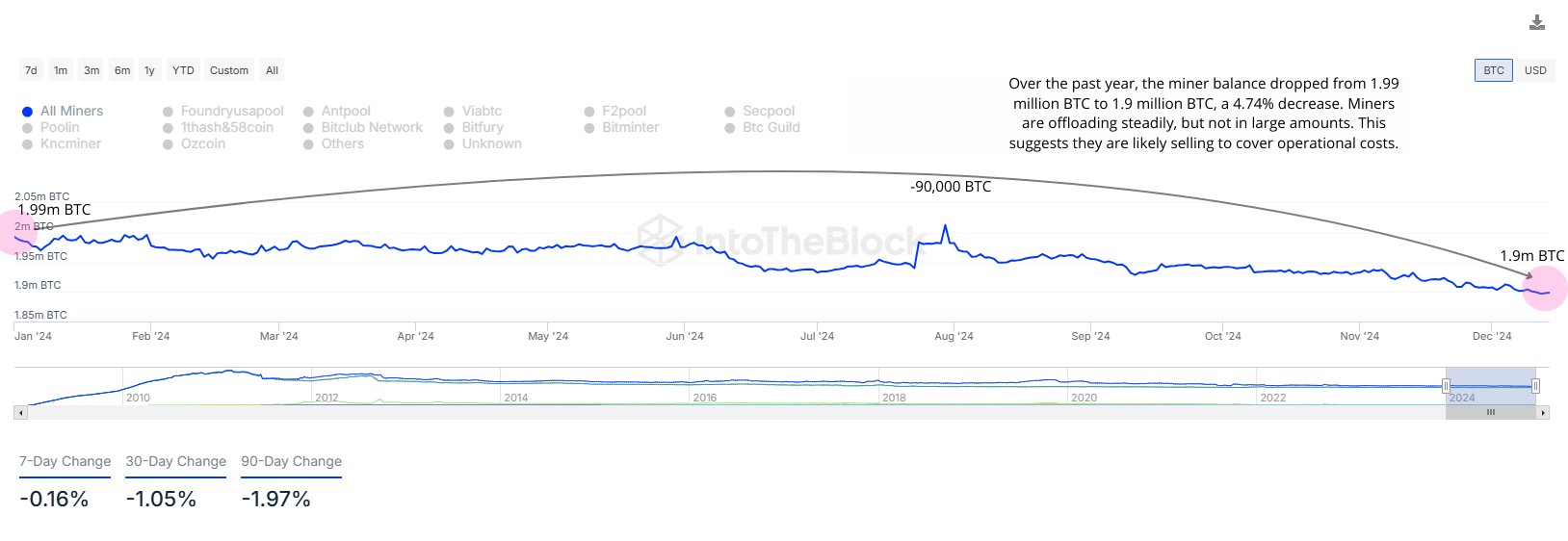

Now, here’s a chart showing the trend in Bitcoin miners’ reserves over the past year:

As shown in the chart above, Bitcoin miner reserves experienced a steady downward trend during this window. While there have been some brief periods of deviation, the overall trajectory remains biased to the downside.

Historically, miners have been consistent sellers on the network. The reasoning behind this is that these chain validators have ongoing running costs in the form of electricity bills, which they repay by selling BTC rewards into fiat currency.

However, generally speaking, although miners are regular sellers, they do not pose much of a threat to prices because the scale of their sales is often easily absorbed by the market. That said, it’s worth being wary of when they do engage in a major sell-off.

At the beginning of this year, Bitcoin miners held a total of 1.99 million Bitcoins in reserves. Today, the same metric stands at 1.9 million BTC, meaning miners have sold 90,000 BTC (approximately $9.3 billion at current exchange rates), or 4.74% of holdings.

Related reading

That’s a noteworthy number in itself, but considering that this sell-off has been going on for some time rather than within a narrow window, the sell-off becomes less interesting.

“Miners are selling steadily, but not in large amounts,” the analyst noted. “This suggests they may be selling to cover operating costs.” Therefore, Bitcoin may not experience any significant negative impact from miner selling. .

However, miner reserves are still worth keeping an eye on in the near future, as any drastic changes in this metric could lead to new outcomes for Bitcoin.

bitcoin price

Bitcoin is set all time high Earlier in the day, the price of the currency crossed the $106,000 mark, but the currency has since appeared to have corrected and is currently trading around $104,000.

Featured images from Dall-E, IntoTheBlock.com, charts from TradingView.com