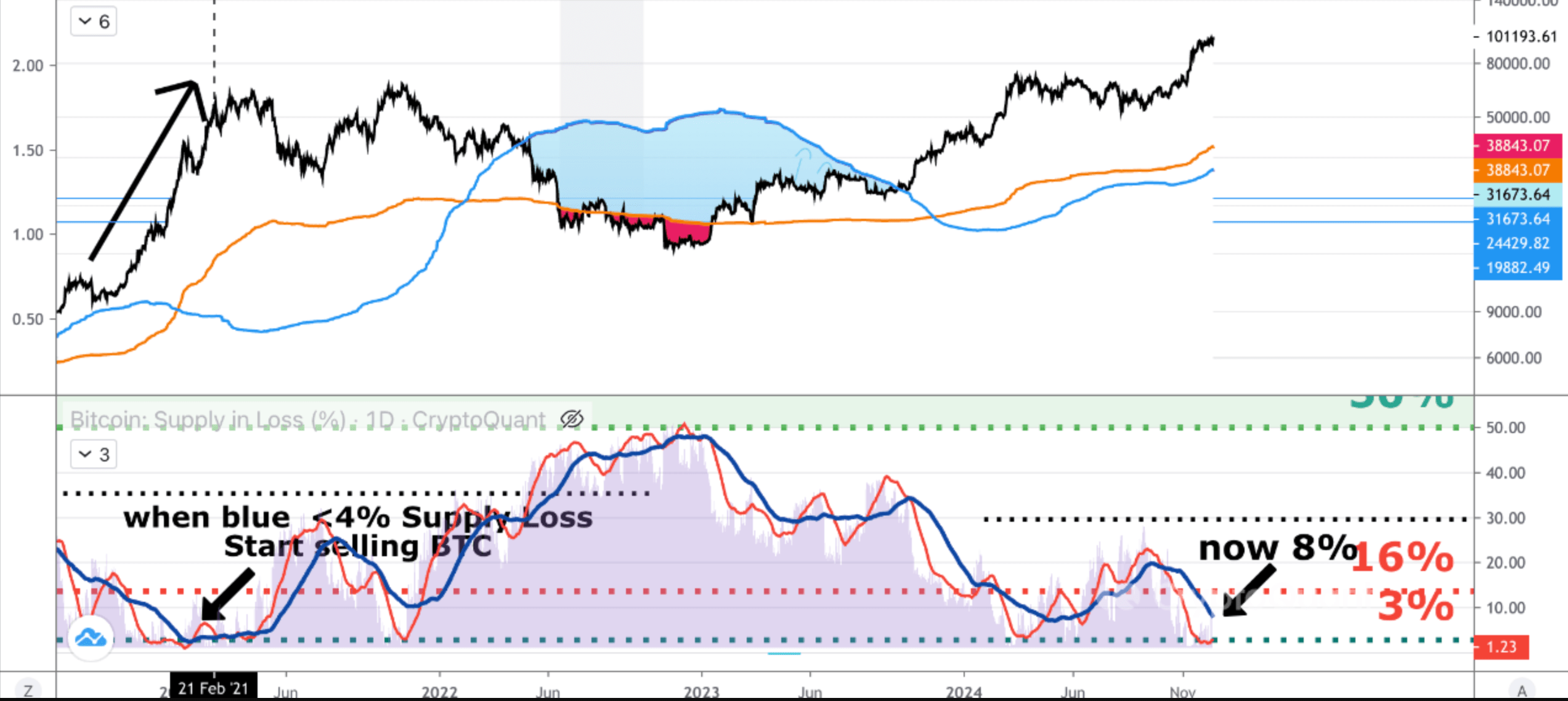

Bitcoin Sell-Off Likely When This Metric Reaches 4%, Analyst Explains

While Bitcoin (BTC) is trading around the key $100,000 price level, some investors may be looking for an ideal opportunity to take profits and exit the market. Against this backdrop, CryptoQuant analysis highlights a key BTC indicator that can serve as a valuable tool in formulating an exit strategy.

Is Bitcoin profitable? Keep an eye on this indicator

In a Quicktake blog post published today, CryptoQuant contributor Onchain Edge shared Insights on the timing of BTC sales during the current bull market. The analyst highlighted the importance of Bitcoin supply in the loss indicator, noting that it could potentially signal when to start exiting the market to preserve profits.

Related reading

For those unfamiliar with Bitcoin, Lost Supply measures the percentage of BTC lost based on the latest price movement. Lower percentage supply losses often indicate peak market excitement and can serve as a warning to secure profits before a bear market correction begins.

According to CryptoQuant’s analysis, when BTC supply losses drop below 4%, it marks a good time for investors to consider dollar cost averaging (DCA) from their BTC holdings and wait for the next bear market low. Currently, the BTC supply loss rate is 8.14%.

DCA is an investment strategy in which investors allocate a fixed amount to an asset at regular intervals, regardless of its price. This approach helps reduce the impact of market fluctuations and lowers the average cost per unit over time. The analyst added:

Why? Below 4% means that many people are making profits and this is the peak stage of the bull market. Trust me, you don’t want to be manipulated because you think we’ll never see a bear market again. Be afraid when others are greedy.

Analysts confident of further Bitcoin price gains

While tracking BTC supply in a loss metric can help investors secure profits, recent predictions from cryptocurrency analysts suggest there may still be room for further gains before the metric becomes critical.

Related reading

According to cryptocurrency analyst Ali Martinez, BTC form The classic cup and handle pattern on the weekly chart. The major cryptocurrency appears poised to break out of a bullish formation with targets as high as $275,000.

Likewise, Donald Trump’s victory has brought new optimism to the crypto industry. Speaking at the recently concluded Bitcoin MENA conference in Abu Dhabi, Trump’s former campaign chairman Paul Manafort said: famous In the current market cycle, BTC investors “expect gains in excess of $100,000.”

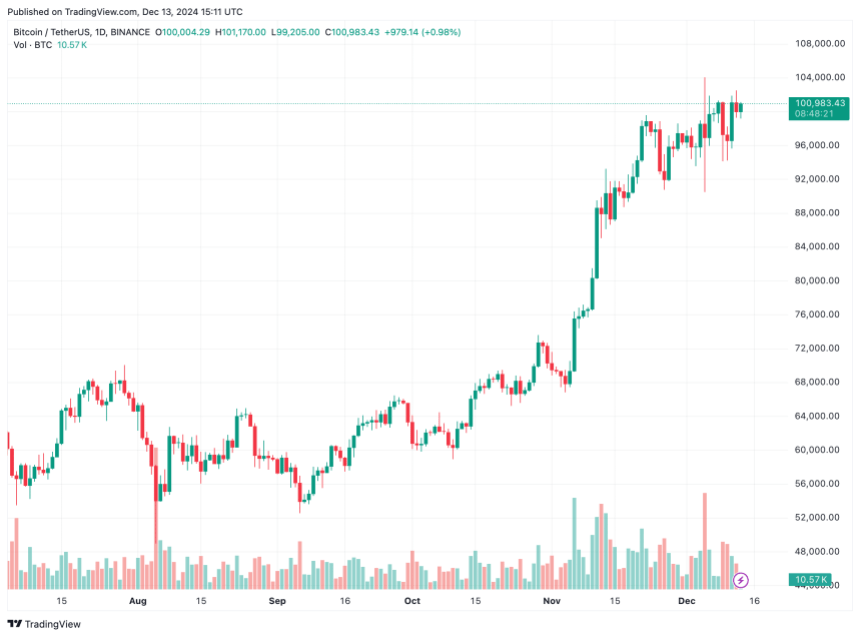

Other forecasts remain equally optimistic. Tom Dunleavy, chief investment officer of MV Global, project During this market cycle, BTC will reach $250,000, while Ethereum (ETH) may climb to $12,000. At press time, BTC was trading at $100,983, up slightly by 0.1% in the past 24 hours.

Featured images from Unsplash, charts from CryptoQuant and TradingView.com