$1.87B Bitcoin Withdrawals From Coinbase In 24H – What This Means To Price

Bitcoin has consolidated below $100,000 for 12 days in a row, marking a pause in its recent historic rally. The sharp rise since November 5 appears to be cooling down, with market attention gradually turning to altcoins. Despite the economic slowdown, Bitcoin remains a cornerstone of market strength, holding above key support at $90,000.

Related reading

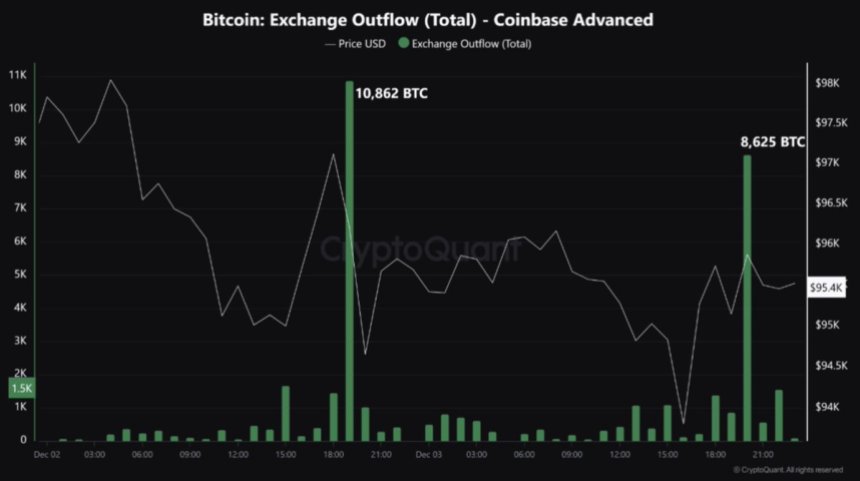

Key data from CryptoQuant shows that Coinbase has experienced two major outflows in the past 24 hours, each of more than 8,000 BTC, indicating continued institutional interest and potential accumulation. These outflows suggest that major players remain optimistic about Bitcoin’s long-term trajectory even as short-term price action stabilizes.

As Bitcoin remains in consolidation phasethe broader crypto market is about to undergo dynamic changes. Analysts are keeping a close eye on whether this period of stability will pave the way for Bitcoin’s next move higher or signal a chance for altcoins to take the spotlight. The next few days will be crucial in determining whether Bitcoin regains momentum or continues its current range-bound moves.

Bitcoin leads the market on fire

Bitcoin continues to lead the cryptocurrency market with significant gains, although its price is just shy of the highly anticipated $100,000 level. The current pause in its rally has triggered a liquidity shift, gradually injecting funds into the altcoin market. However, analysts and investors expect that Bitcoin may slow down in the short term after its recent surge, giving other cryptocurrencies a chance to shine.

CryptoQuant’s metrics highlight notable activity on Coinbaserecorded two large outflows in the past 24 hours, each exceeding 8,000 BTC. Across these transactions, a total of 19,487 BTC was withdrawn at an average price of $96,043 and an amount of approximately $1.87 billion. Such a significant move indicates the involvement of institutional players or whales who may be gearing up for Bitcoin’s next big move.

Historically, market declines have tended to be accompanied by similar outflows, as large trades often signal profit-taking or a reallocation of holdings. However, these transactions may also indicate growing confidence among major investors in Bitcoin’s long-term potential.

Related reading

If BTC sustains above $90,000 and demand continues to increase, the market may push towards six-digit territory again in the coming weeks.

Price levels worth watching

Bitcoin is currently trading at $96,700 and continues to range-bound between $93,500 and $98,700 without establishing a clear direction. The consolidation follows a period of sharp gains that has seen Bitcoin approach but not yet surpass its all-time highs.

Market participants are keeping a close eye on the $90,000 mark, which has proven to be a key support level. Staying above this level is critical to signaling market strength and sustaining bullish momentum.

If Bitcoin sustains above the $95,000 mark in the coming days, the likelihood of a breakout to new all-time highs becomes significantly stronger. A steady consolidation above this level will encourage buyers to push Bitcoin past the psychological $100,000 mark.

Conversely, the loss of support at $95,000 would raise concerns that the $90,000 level could be retested. If this key level fails, Bitcoin could experience a deeper correction at lower support areas.

Related reading

Bitcoin’s ability to remain above $95,000 will be crucial in determining its next move. Bulls are eyeing another rally, while bears are looking for signs of exhaustion to take advantage.

Featured image from Dall-E, chart from TradingView