Bitcoin Price Supported By All-Stablecoins Cash Inflow – Data Reveals Strong Correlation

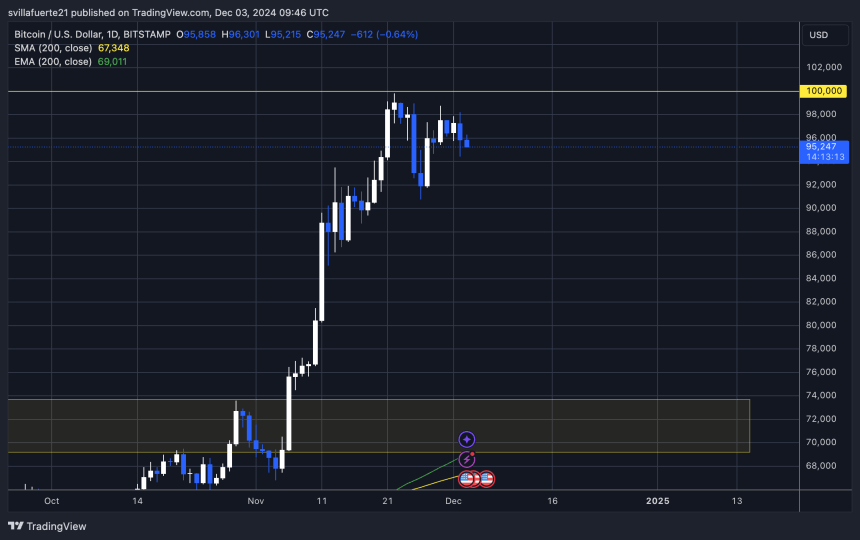

Bitcoin has entered a period of calm after a dramatic drop from $99,000 to $90,000 in just three days. Currently, the leading cryptocurrency is trading above $95,000, with key levels likely to determine its next move. This key area will determine whether Bitcoin regains upward momentum or seeks lower levels of liquidity to establish stronger support.

Related reading

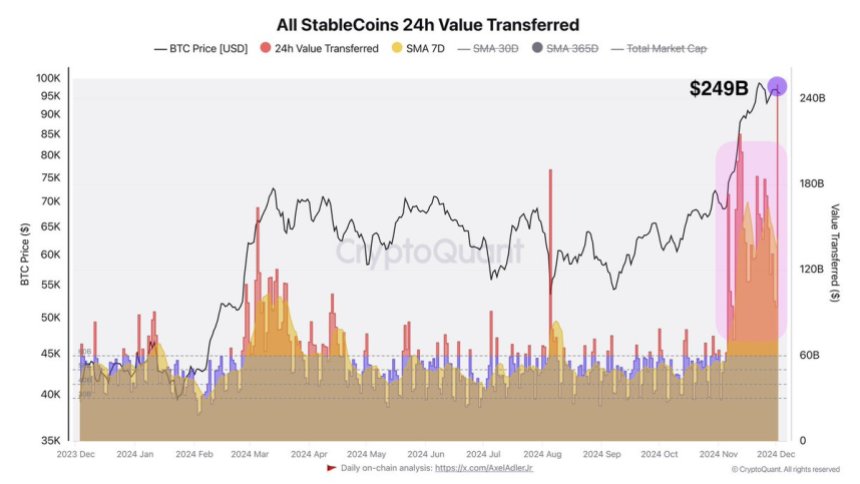

Despite recent volatility, market participants remain optimistic as on-chain data provides new insights. According to CryptoQuant, the significant rise in stablecoin transfer volumes coincides with Bitcoin’s price action. This indicator typically indicates an increase in purchasing power entering the market, a potential precursor to renewed buying interest in Bitcoin.

As Bitcoin consolidates above $95,000Traders and investors are closely watching its ability to reclaim psychological resistance at $100,000. Conversely, the loss of support could push BTC to retest lower levels near $90,000 and even deeper liquidity areas.

Bitcoin and Stablecoins: What do they have in common?

Driven by a wave of institutional and retail buying, Bitcoin has achieved a remarkable milestone and is less than 1% shy of the coveted $100,000 mark. The historic rise reflects growing global demand, with investors from different countries leveraging the stablecoin to buy Bitcoin. Stablecoins have become the bridge of choice, enabling seamless transactions across borders and currencies.

CryptoQuant analyst Axel Adler saidThe recent surge in stablecoin transfer volumes has coincided with a rise in the price of Bitcoin. This trend highlights the important role of stablecoins in providing liquidity and driving market momentum. Cash flow inflows via stablecoins have provided strong support to Bitcoin’s price, allowing it to maintain upward pressure even as it approaches key psychological levels.

The correlation between stablecoin activity and Bitcoin price movements provides valuable insights into market dynamics. An increase in stablecoin transfers generally indicates increased demand for Bitcoin, providing a reliable indicator of potential price movement. This interaction is especially important in identifying periods of high buying pressure, as stablecoins facilitate fast and efficient market participation.

Related reading

As Bitcoin approaches the $100,000 milestone, the continued influx of stablecoin-driven liquidity highlights the asset’s global appeal and resilience. Whether this momentum leads to a breakout of $100,000 or a period of consolidation, stablecoins’ role in stimulating demand will still play a key role in shaping Bitcoin’s price trajectory.

BTC price approaches critical zone

Bitcoin is currently holding above the key level of $95,000, a price that will play a decisive role in its short-term trend. This level serves as an area of psychological and technical support that could push BTC past the long-awaited $100,000 milestone this week, or delay the breakthrough until next year.

For Bitcoin to break above $100,000, the $95,000 level must hold for a few days to allow enough time to stimulate demand and attract new liquidity. Sustained buying pressure around this range could allow Bitcoin to break through key psychological barriers and continue its historic rise.

However, the bullish momentum is at risk. Failure to hold $95,000 levels puts Bitcoin at risk of a retest of $92,000, another key support level. Losing these two levels could trigger a major correction, sending Bitcoin down to lower demand areas around $85,000 or below $80,000. The move would significantly reverse recent gains and shake market confidence.

Related reading

The next few days will be critical as traders will focus on continued support above $95,000. If the bulls defend this level effectively, Bitcoin could head towards $100,000 soon. Otherwise, the market could be gearing up for further pullbacks before resuming upward momentum.

Featured image from Dall-E, chart from TradingView