Ethereum Breaks Resistance Levels, Analyst Predicts Room For More Growth

The price of Ethereum, the second-largest cryptocurrency by market capitalization, has finally rebounded significantly and continues to break through significant resistance levels.

Along its upward trajectory, see An increase of nearly 10% In the past week, discuss On how Ethereum could reach new all-time highs by the end of the year Gained momentum.

Notably, consistent with the ongoing ETH rally, there is renewed interest in Ethereum futures, with market indicators pointing to bullish sentiment among traders.

Related reading

More room for growth?

A CryptoQuant analyst named ShayanBTC recently shared insights into Ethereum’s continued rise, highlighting the role of funding rates – a key metric in futures trading. Funding rates reflect trader sentiment and indicate whether the market is primarily bullish or bearish.

Shayan said Ethereum’s funding rates have increased significantly in recent weeks, indicating that demand for long positions is growing.

Despite this bullish sentiment, the analyst mentioned that funding rates are still below Ethereum’s previous all-time high peak of $4,900, indicating that “it has not yet entered an overheating state.”

At the same time, while signaling bullish sentiment, funding rates have also emerged as a warning sign of a potential market correction. Historically, sharp increases in funding rates have been followed by sudden market corrections or liquidation cascades.

However, Shayan noted that Ethereum’s current funding rates remain manageable, meaning the market has More room for growth before such risks become serious.

Ethereum market performance and outlook

Ethereum is currently experiencing Upward trajectoryachieving double-digit gains of approximately 15.6% in the past two weeks. This bullish performance pushed ETH above key resistance at $3,500, setting sights on next major resistance The $4,000 mark.

Currently, Ethereum is trading at $3,563, up 1.3% in the past 24 hours. However, the price is down slightly from the 24-hour high of $3,682 set earlier today.

Furthermore, Ethereum’s current price is only 26.78% below its all-time high of $4,878, highlighting its gradually recover Within the market.

Related reading

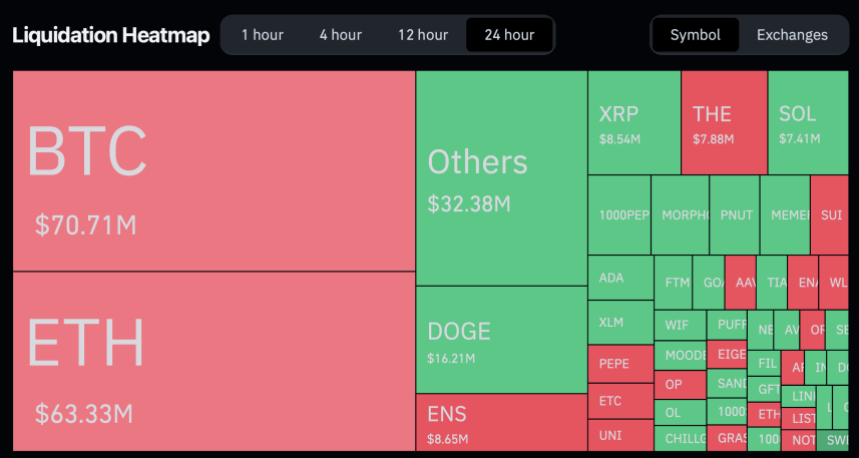

Regardless of bullish sentiment, Coinglass data It shows that 98,389 traders were liquidated in the past 24 hours alone, with a total liquidation of $278.03 million.

Of the total liquidations, Ethereum accounted for approximately $63.33 million, of which $40 million came from short positions and $23.3 million from long positions.

On Ethereum’s current price performance, Ali, a well-known cryptocurrency analyst on reiterate His target is ETH. Ali said the mid-term target remains $6,000 and the long-term target is $10,000.

Our mid-term goal is #Ethereum $ETH Still $6,000…long term goal: $10,000! https://t.co/X4lodGGIVY pic.twitter.com/siQsJzelzE

— Ali (@ali_charts) November 27, 2024

Featured image created using DALL-E, chart from TradingView