Over $500 Million Liquidated As Bitcoin Slides To $92K

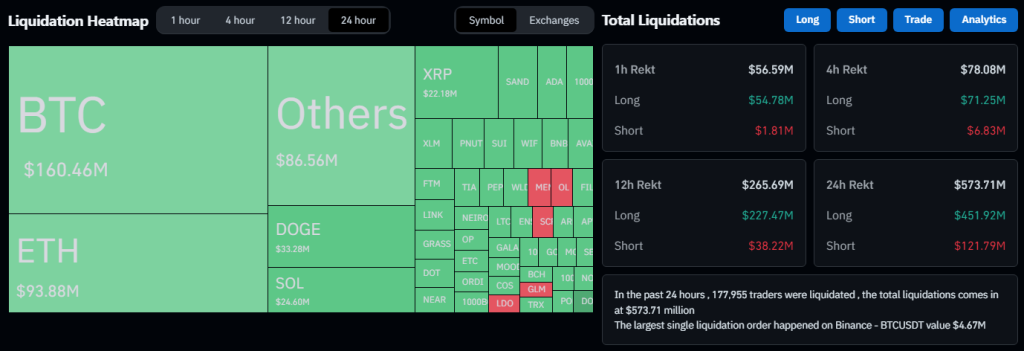

Over the past few days, the crypto space has changed dramatically. In just 24 hours, more than $550 million was liquidated. When Bitcoin fell to weekly lows, it triggered a massive sell-off that left around 170,000 trader accounts in the red.

Related reading

Korn Glass reports Bitcoin long positions lost $118 million, Ethereum long positions lost $54 million, and Dogecoin long positions even lost $25 million.

The surge in liquidations, coupled with declines in market capitalization and trading volume, highlighted the volatility traders can expect. Analysts believe this is part of a broader correction pattern occurring after Bitcoin’s recent rally to near all-time highs.

Bitcoin Dominance and Liquidation Trends

Bitcoin’s dominance remains strong, with a current market capitalization of $3.23 trillion, accounting for more than 56% of the total cryptocurrency market. The highest liquidation of the day was $4.67 million on the BTC/USDT exchange on Binance, indicating the high risk involved in leveraged trading.

Additionally, altcoins are not immune. Tokens with smaller market caps saw sharp declines, with the broader market losing about $100 million.

Some analysts believe this is just another common correction after Bitcoin prices surged nearly 44% since early November. Currently, the Cryptocurrency Fear and Greed Index is at 82, indicating that market dominance remains “Extreme greed.”

Ethereum and altcoins remain stable

Ethereum While it wasn’t immune to the day’s losses, it remained resilient. The liquidation of both long and short ETH positions highlights the uncertain mood surrounding the second-largest cryptocurrency.

During this period, altcoins such as Dogecoin, often buoyed by meme-driven enthusiasm, experienced the effects of market corrections, which served as a warning to traders looking for quick profits.

An industry analyst named Miles Deutscher noticed that more and more traders were reactivating their wallets after not using them for several months. They do this because they are interested in the possibilities of altcoins and the strong performance of Bitcoin. This increase in activity can lead to growth and volatility as the market continues to follow its usual trends.

Related reading

Bitcoin’s future path

exist $92,801, Bitcoin remains behind its all-time high of $99,750 set earlier this month. Analysts are divided on the next move; some believe the market is ready for consolidation before prices surge above $100,000 again. Others warn that excessive leverage could lead to greater volatility in the short term.

Investors are paying close attention to market sentiment and macroeconomic factors. While current conditions may foster bullish momentum, the cryptocurrency market’s wild price swings and substantial leverage risk remind us of its unpredictability.

Featured images from DALL-E, charts from TradingView