10% Surge Sparks ATH Hopes

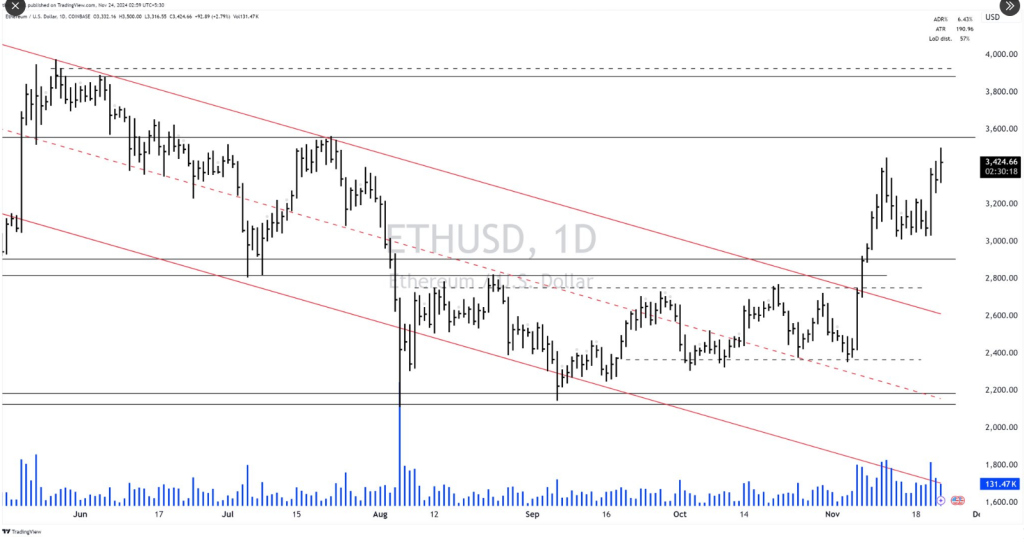

Ethereum (ETH) has broken out of an eight-month downtrend and is back in the news. This marks a major turning point for the second-largest cryptocurrency by market capitalization.

The currency rose by more than 5% in a single day, reaching $3,525. Up 38% in the past 30 days. Analysts are buzzing, suggesting that ETH still has plenty of upside potential as it continues to rise.

Related reading

This latest breakthrough inspired more market confidence. ETH has gained 10% over the past week, confirming its dominance in the cryptocurrency space. Technical analysts such as Logical Trader say this action marks the beginning of a long-term bullish trend, with a clear mid- to long-term expansion.

How is ETHUSD trending?

This is what happens when price breaks out of a downtrend channel. #cryptocurrency #Ethereum pic.twitter.com/tepsK7grmO— Logical Trader (@logicaltra6er) November 23, 2024

Bullish technical signals

Ethereum’s technical indicators show a strong upward trend. The relative strength index (RSI) has reached 70, indicating strong buying pressure. Additionally, ETH has broken above the 30 and 200-period moving averages, reinforcing its bullish trend.

Titan of Crypto noticed an interesting development: weekly closures are higher than Kumo Cloud. If momentum continues, a second target could be $4,862, a technical breakout that predicts ETH may soon test resistance near $4,189.

#altcoin #Ethereum The golden cross is coming🚀#ETH Close above weekly level: an important milestone.

This breakout could pave the way for $4,100 next! 🎯 pic.twitter.com/q0eOVgxgnU

— Cryptocurrency Titan (@Washigorira) November 25, 2024

With the upcoming Golden Cross, the short-term moving average will cross the long-term moving average, and the upside will be further boosted. In fact, this has historically resulted in very strong price increases. If this bullish sign is accompanied by sustained buying activity, ETH may approach these higher price levels in the near term.

Ethereum fundamentals remain solid

In addition to its technical prowess, Ethereum also shines due to its strong dominance in decentralized finance (DeFi) and countless blockchain applications. The network holds more than half of the total value locked in DeFi, so it is definitely relevant to the ecosystem.

Additionally, the emergence of ETH-based layer 2 solutions improves their scalability and is attractive to both developers and users.

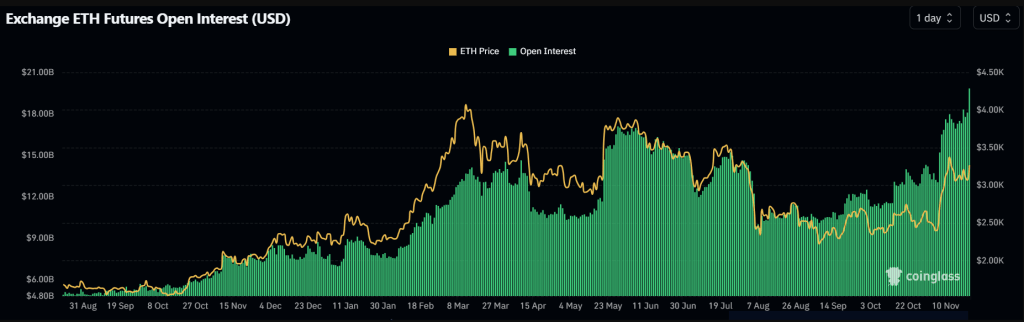

Meanwhile, activity in the Ethereum derivatives market is surging. Open interest has exceeded $20 billion, with traders eyeing expiring options at $3,400 and $3,500. The increase in transactions per block also drives up fees, reducing the circulating supply of ETH and potentially raising the price further.

Related reading

Room to grow in optimism

Although Ethereum’s price has increased 66% in the past year, many analysts say it remains undervalued. The prediction of a rise of more than $4,800 this cycle shows the market’s confidence in ETH’s future.

At the same time, if pro-cryptocurrency legislation is passed in the United States, it could further accelerate the rise of cryptocurrencies. Ethereum looks set to rise, possibly even to new all-time highs, because its fundamentals are strong, it’s growing in popularity, and its technical setup is good.

Featured images from DALL-E, charts from TradingView