Bitcoin Realized Profit Hits ATH At $443 Million – Local Top Or Continuation?

Bitcoin has soared to the $99,800 mark, setting a new all-time high and approaching the psychological $100,000 mark. While this milestone signals extraordinary strength, prices have yet to reach this critical level, leaving investors in suspense. Market demand remains strong, fueling optimism that Bitcoin will soon surpass the $100,000 mark.

Related reading

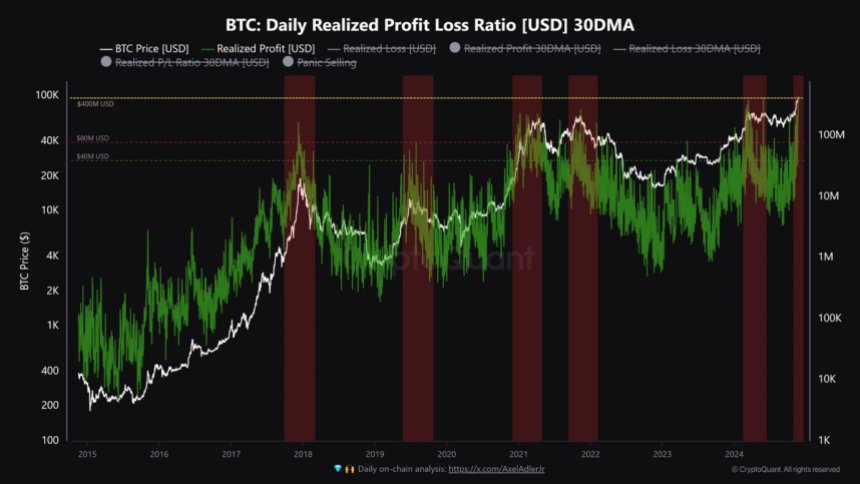

Key data from CryptoQuant shows that Bitcoin’s realized profits have reached an all-time high of $443 million in daily gains. This highlights the intense buying pressure in the market as traders and long-term holders lock in unprecedented profits. However, the record-breaking profit-taking has also raised concerns among some investors. They fear the rally could stall, interpreting the surge in realized profits as a potential signal of a local top-case scenario.

Despite these mixed signals, overall market sentiment is biased towards the bullish side. Bitcoin continues to hold above a key support level, indicating that demand remains strong enough to fuel the next leg higher. With the cryptocurrency still far away from a major breakout, the coming hours and days will be crucial in determining whether Bitcoin’s momentum can sustain a decisive move above $100,000, or if a temporary consolidation is imminent.

Bitcoin rally could continue above $100,000

Bitcoin’s rise from $66,800 to $99,800 marks a unique and unexpected bullish phase in 2024. As the price approaches the elusive $100,000 milestone, many investors who doubted whether Bitcoin was likely to reach that level this year are now revising their expectations. Strong demand and market confidence have driven prices soaring, with prices above $100,000 seemingly inevitable. If this happens, analysts generally expect Bitcoin to continue its bullish run, further solidifying its dominance in the cryptocurrency space.

Related reading

However, market dynamics suggest that the journey to $100,000 may not be without obstacles. Adjustments at this stage are not only possible, but may also be beneficial to market health. A pullback will provide an opportunity for consolidation, potentially giving altcoins room to recover and launch a rally.

Key insights from CryptoQuant analyst Maartunn reveals the radical nature of this rally. Data shows that Bitcoin’s realized profits recently hit an all-time daily high of $443 million, reflecting significant profit-taking activity. While this confirmed strong buying pressure, it also raised concerns among cautious investors, who viewed the surge in profits as a potential sign of a local peak.

Despite these concerns, Bitcoin’s trajectory still has room to grow. Sustaining support above $95,000 will maintain the bullish momentum, but a healthy correction from current levels could also provide the momentum needed for a stronger break above $100,000 in the near future.

BTC tests critical supply

Bitcoin is currently holding above the $97,000 mark, maintaining its bullish momentum and looking to cross the $100,000 milestone. This level represents a significant psychological and technical hurdle, and market sentiment remains optimistic about Bitcoin’s potential to break above this level. As demand remains strong, many investors are bracing for an explosive surge that could determine Bitcoin’s trajectory in the coming weeks.

However, there are growing concerns that Bitcoin could hit a local high. If this scenario materializes, prices could enter a consolidation phase that could last for weeks as the market digests recent gains. Analysts say that holding the $98,000 level in the coming days will keep the bullish momentum intact and set the stage for a breakout above $100,000.

Related reading

On the other hand, if Bitcoin fails to hold the $97,000 mark, it could signal the beginning of a healthy correction. In this case, the price could retrace towards the $92,000 level, a key demand area that could act as strong support. A pullback to this level would allow Bitcoin to regroup and set the stage for another move higher, reinforcing its long-term bullish trend.

Featured image from Dall-E, chart from TradingView