Bitcoin Attempt To Dip Below $96K ‘Led To Nothing’ – Analyst Expects $100K Soon

Bitcoin has been on a significant upward trajectory, surpassing the $96,000 mark on consecutive days after consolidating below the psychological $100,000 level. Bitcoin, the leading cryptocurrency, has been breaking all-time highs over the past three weeks, setting a landmark weekly close of $98,000 yesterday – its highest level ever.

Related reading

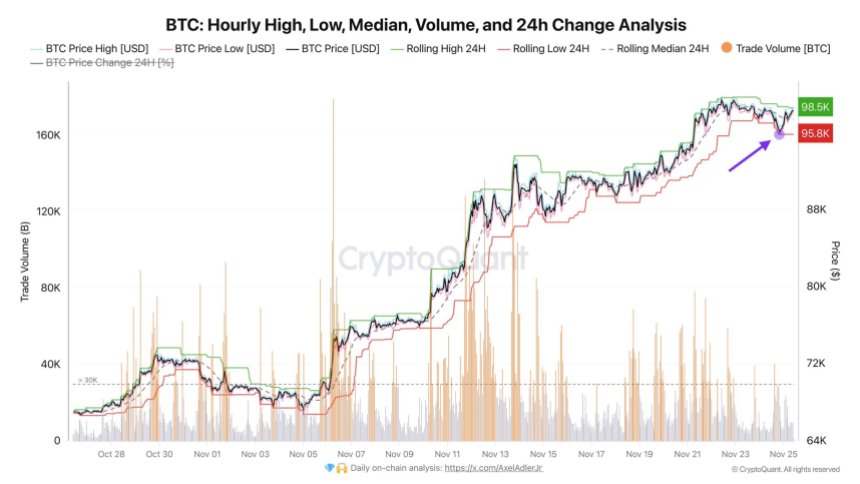

CryptoQuant analyst Axel Adler shared an insightful analysis of Adler said the market is now bracing for a key test of the $100,000 mark, a hurdle that could spark further bullish momentum or signal a short-term consolidation phase.

Bitcoin’s bullish trajectory shows no signs of slowing downtraders and investors are closely watching a break above $100,000. The move could ignite broader market optimism and reignite interest in altcoins, potentially influencing the next phase of growth in the cryptocurrency market. However, failure to break through this key level could trigger a healthy correction, setting the stage for a more sustainable rebound.

Bitcoin price action remains strong

Despite Bitcoin’s recent retracement from $99,800 to $95,800 (a slight drop of less than 4%), its price action remains unusually bullish. Investors generally view this pullback as a brief consolidation phase before breaking through the key $100,000 mark.

The resilience shown during this pullback has boosted confidence among market participants, with many viewing it as a healthy pause in the ongoing upward trend.

Renowned CryptoQuant analyst Axel Adler weighs in on recent market trends via Xshared technical analysis that reinforces a strong bullish structure for Bitcoin. Adler emphasized that pushing Bitcoin to lower demand levels has been unsuccessful, further solidifying the current support area.

According to his insights, Bitcoin is now ready to finally test the key $100,000 area and gauge the market’s reaction at this psychological threshold. As Bitcoin approaches this milestone, investor sentiment appears to be divided. Many traders believe the $100,000 level is the ideal price to begin taking profits, citing the historical pattern of pullbacks after major round-number milestones.

Related reading

However, others remain optimistic about Bitcoin’s continued strength, predicting that its price could soar past $100,000. Predictions for the peak of the rally range from $105,000 to $120,000, reflecting broader confidence in the cryptocurrency’s long-term potential. Whether Bitcoin consolidates or continues its climb, all eyes are on where it goes next.

Bullish weekly close could push Bitcoin higher

Bitcoin posted its highest weekly closing price ever, reaching an impressive $98,000. This milestone is a technical achievement and an important psychological boost for market participants. This signals a strong bullish environment that could soon push Bitcoin past the coveted $100,000 mark.

The $98,000 level is now a strong support area and sustaining this price (or at least staying above $95,000) will be crucial in the coming days. A break above these levels could propel Bitcoin towards $100,000 with strong momentum. The move will solidify Bitcoin’s upward trend and attract further interest from both retail and institutional investors.

Related reading

However, continued consolidation below $100,000 is still possible. Bitcoin may need a few weeks of sideways trading to accumulate the strength needed for the next leg higher. While short-term traders may be frustrated, this consolidation phase will provide a healthy foundation for sustainable growth.

Featured image from Dall-E, chart from TradingView