Polkadot Holds Key Demand Level – DOT Could Hit $11 In Coming Weeks

Polkadot (DOT) has entered a consolidation phase and is trading below the $6 mark after a strong 30% rally since Friday. This period of sideways movement has brought some volatility, but market conditions suggest DOT may be preparing for its next big move. Despite temporary resistance near $6, investors are keeping a close eye on the asset as it retains a bullish structure.

Related reading

Top cryptocurrency analyst Ali Martinez shared a technical analysis highlighting Polkadot’s resilience. Martinez said the DOT kept the company’s stock above key demand areas, suggesting the asset could be primed for a major breakout. His insights illustrate the growing interest and optimism in Polkadot due to its potential to become bullish again.

As one of the leading blockchain ecosystems with strong interoperability solutionsPolkadot continues to attract attention in a market increasingly favoring quality projects. The next few days will determine whether DOT can use the recent momentum to break through key resistance levels. All eyes are on Polkadot’s price action as it tests investor confidence and market strength. If the expected surge materializes, DOT may soon be able to regain higher ground, further solidifying its position in the cryptocurrency space.

Polkadot prepares for breakout

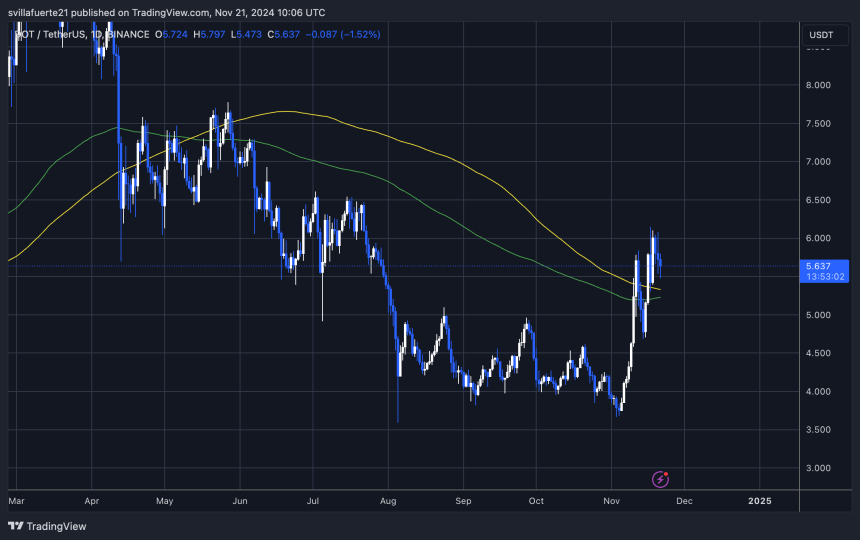

Polkadot appears to be on the verge of a breakout, maintaining bullish momentum despite the recent pullback from $6 resistance. After retracing nearly 10%, DOT has stabilized above the key demand area of $5.7, indicating that buyers remain firmly in control of the market. This resilience has fueled optimism among investors and analysts, who see current price action as the basis for a sharp rebound.

Top cryptocurrency analyst Ali Martinez recently shared his insights on Xpointed to Polkadot’s weekly price chart as evidence of its potential. Martinez said DOT remains above support at $3.6, showing exceptional strength that is the basis for its near-term recovery. He said that if the current momentum continues, DOT could climb to $11 in the coming weeks, a significant increase from current levels.

Martinez also highlighted that reaching and consolidating above the $11 mark could set the stage for a larger rally. He predicted that the move would open the door for a price surge to $22, in line with broader bullish expectations in the altcoin market.

Related reading

With Polkadot’s fundamentals and technical setup aligned, all eyes are on its ability to overcome key resistance levels. If these predictions come true, DOT could re-establish itself as a leader in the cryptocurrency market.

DOT Price Trend: Technical Details

Polkadot is trading at $5.6, holding above the key 200-day moving average (MA) of $5.3. A breakout of this key indicator is a strong bullish sign, suggesting DOT is showing long-term strength as buyers gain control. Prices also remain firmly above the $5.6 demand level, which was an important support during June and July but was lost until the recent recovery.

Demand levels are back at $5.6, reigniting investor optimism as sustaining this area could set the stage for further bullish momentum. If DOT manages to stabilize above this level in the coming days, a move to a new supply zone is likely, with the next target around $6.5.

Related reading

A break above the 200-day EMA and a return to significant demand levels suggests that DOT has the potential to sustain its current upward trajectory. However, sustained buying pressure is needed to overcome resistance and push higher. Currently, all eyes are on whether DOT can consolidate above $5.6, which will be a key indicator of whether it can continue to climb higher in the coming weeks.

Featured image from Dall-E, chart from TradingView