Bitcoin LTHs Start Taking Profits – Metrics Reveal Whales Are Actively Spending

Bitcoin has hit all-time highs for four consecutive days, hitting $99,500 just hours ago. The continued surge has fueled extremely bullish sentiment in the market, with investors eagerly anticipating Bitcoin’s historic breakthrough to the $100,000 mark. However, on-chain data suggests the rally may face challenges as signs of profit-taking emerge.

Related reading

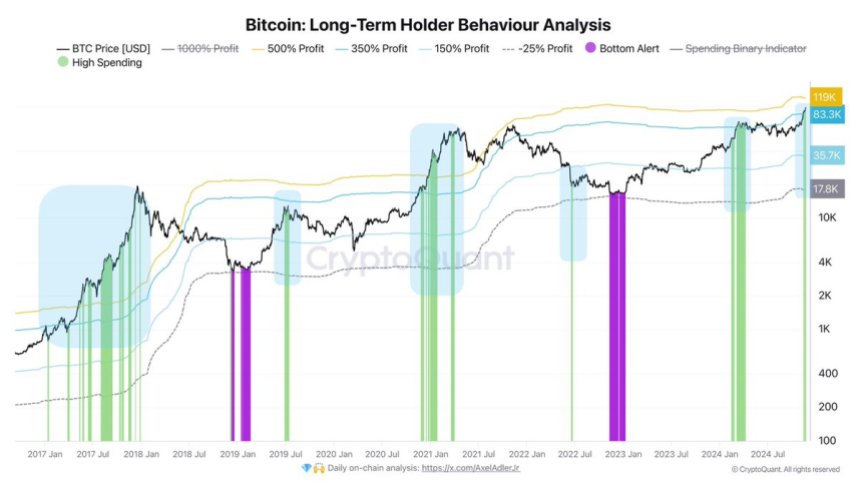

Key insights from CryptoQuant show that long-term holders (LTH) are actively spending Bitcoin, with profits exceeding 350%. This behavior suggests that some experienced investors are starting to lock in gains after a sharp uptrend. Whale activity and profit-taking in LTH may temporarily slow the rally and could trigger a consolidation phase before the next leg higher.

Although Bitcoin still exists One step away from the six-figure milestonethe market carefully scrutinizes Can it maintain its momentum, or is a pullback imminent. Consolidation at these levels could set the stage for BTC to resume its bullish trend and break above the psychological barrier of $100,000.

Bitcoin’s rise appears unstoppable

Bitcoin has soared 45% since November 5, showing a seemingly unstoppable continued upward trend. Despite increased selling activity, demand continues to support prices, pushing Bitcoin to new highs and maintaining its bullish trajectory. As Bitcoin moves further into uncharted territory, market participants are now closely watching for signs of a potential slowdown or correction.

CryptoQuant analyst Axel Adler recently shared X data highlighting A notable trend among long-term holders (LTH). Adler said that LTH is actively consuming Bitcoin, with profits exceeding 350%. This marks a critical moment, as these holders are often seen as market stabilizers and their selling activity could signal a potential shift in market sentiment.

Adler further pointed out that if the price of Bitcoin exceeds $119,000, LTH profits will surge to more than 500%. Such extraordinary profit levels could trigger a wave of selling pressure, potentially leading to the first major correction since this unprecedented rally. However, he emphasized that the exact price point for the forecast adjustment remains speculative as there are no concrete forecasts.There is a definite threshold that determines when LTH is likely to exit its position in a landslide.

Related reading

While the rally shows no signs of slowing down, this dynamic between demand and LTH profit-taking highlights the importance of monitoring market behavior. With Bitcoin rising rapidly, traders should remain cautious.

BTC is about to hit $100,000

Bitcoin is trading at $98,600, less than 2% away from the much-anticipated $100,000 mark. This psychological level is expected to become an important supply area, with many investors paying close attention to price action surrounding this milestone. The recent “up only” price action leaves little room for traders to buy at lower levels, frustrating those hoping to buy on the dip.

If Bitcoin holds above the key $93,500 support level in the coming days, market sentiment suggests that a strong surge above $100,000 could follow. A break above this barrier could bring further bullish momentum, pushing Bitcoin into uncharted territory and fueling optimism for further gains.

However, failure to hold the support at $93,500 may trigger selling pressure, leading to a price pullback. In this case, Bitcoin may test lower demand areas, with $85,000 and $80,000 identified as key levels to watch. These areas can provide new accumulation opportunities for investors seeking to take advantage of price corrections.

Related reading

As Bitcoin approaches this all-time level, the coming days will determine whether the market maintains a bullish trend or enters a consolidation phase. As Bitcoin moves through this critical moment, traders and investors should remain vigilant.

Featured image from Dall-E, chart from TradingView