Bitcoin Demand Outweighs Supply As LTH Enter Active Distribution Phase

Bitcoin (BTC) has been holding steady above the $88,000 mark over the past few days, showing resilience as the broader market anticipates its next move. Price action remains strong, frustrating investors waiting for a price drop as Bitcoin shows no signs of providing an easy entry point in the short term.

Related reading

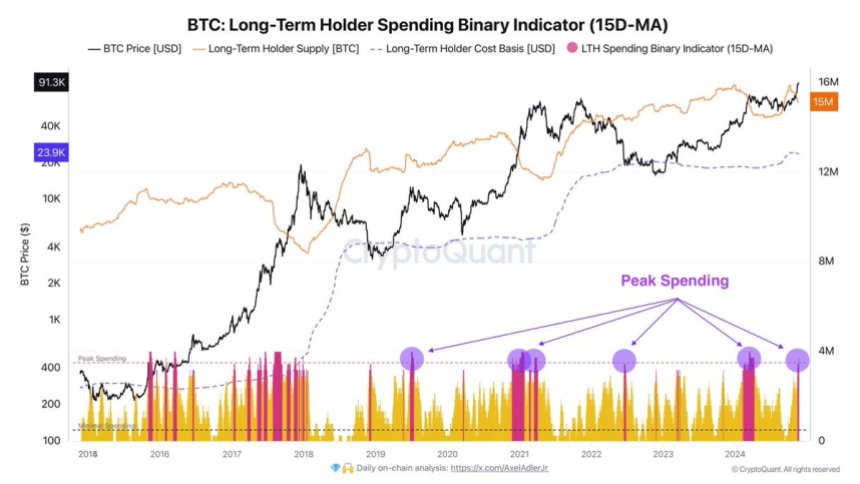

Key data from CryptoQuant shows that long-term holders (LTH) are currently in an active allocation phase, indicating increased selling activity among this group. Still, the market absorbed the additional supply without a major impact on price, highlighting the strong demand supporting Bitcoin at these levels.

As Bitcoin consolidates below its all-time highsTraders and analysts are keeping a close eye on whether the current momentum will lead to a breakout, or if a pullback is imminent. The balance between demand growth and LTH allocation may determine BTC’s near-term direction.

Could Bitcoin hit a new ATH this week?

Bitcoin is on the verge of another all-time high (ATH) this week, just 2% below the $93,483 level set last Wednesday. Excitement is growing as analysts and investors closely monitor Bitcoin’s price action, anticipating whether it will break out of this key level or enter a prolonged consolidation phase.

While bullish momentum remains strong, the possibility of a sideways move could keep prices range-bound for an extended period before the next major move.

Data from CryptoQuant analyst Axel Adler highlights that long-term holders (LTH) are currently in an active allocation phase. Still, the increase in supply has not had a major impact on Bitcoin’s price as strong demand continues to absorb selling pressure. This dynamic reflects strong market interest, supporting Bitcoin near all-time highs.

Adler’s analysis also pointed to the LTH spending binary indicator, which indicates a spike in spending activity among LTHs. At the same time, the growing supply of LTH indicates that some long-term holders remain confident in the future price potential of BTC. These factors create a unique environment where high demand offsets allocations, keeping bullish momentum intact.

Related reading

As Bitcoin flirts with ATH, market participants are awaiting confirmation on whether the price will enter uncharted territory or pause for consolidation. The results could set the tone for Bitcoin in the coming weeks, with investors betting the rally will continue.

Bitcoin Price Action: Key Levels to Hold

Bitcoin is currently trading at $91,820, having been consolidating just below its all-time high (ATH) for the past few days. Despite the pause, BTC has held above the $87,000 support since the last breakout, demonstrating its importance as a key line for bulls to defend. Holding this level is critical to sustaining upward momentum and setting the stage for Bitcoin to move into uncharted territory.

However, a break below $87,000 could change market sentiment, possibly triggering a correction as BTC finds new demand. The next logical area of support lies near the $80,000 mark, with the potential for a further pullback if selling pressure intensifies. This pullback will provide opportunities for buyers on the sidelines, but may temporarily hinder Bitcoin’s gains.

Bitcoin’s price action remains strong, supported by demand continuing to outpace supply. This strong market interest has mitigated the impact of profit-taking and selling activity, maintaining the broader uptrend.

Related reading

With BTC consolidating near its ATH, traders are keeping a close eye on key levels to determine whether a break to new highs or a decline to test lower support areas is next. Either outcome will likely impact Bitcoin’s trajectory in the coming weeks.

Featured image from Dall-E, chart from TradingView