Is $135,000 Bitcoin’s Current Ceiling? This Model Says So

The founder of CryptoQuant has shared a Bitcoin model that suggests the cryptocurrency’s top price could currently be around $135,000.

Bitcoin model built on realized caps can reveal price ceilings and floors

in a new postal At X, CryptoQuant founder and CEO Ki Young Ju discussed a BTC pricing model based on a realized cap. this”Cap achievedThis refers to Bitcoin’s on-chain valuation model, which assumes that the “true” value of any coin in circulation is the price at which it was last traded on the blockchain.

For any token, its last transfer likely represents the last time it changed hands, so the price at that time can be considered the token’s current cost basis. Therefore, the realized cap is the sum of the cost base of all tokens on the network.

In other words, the realized cap measures the total amount of capital invested by cryptocurrency holders as a whole. By dividing this metric by the total circulating supply, a new metric is derived that represents the average token on the chain or the cost basis for investors.

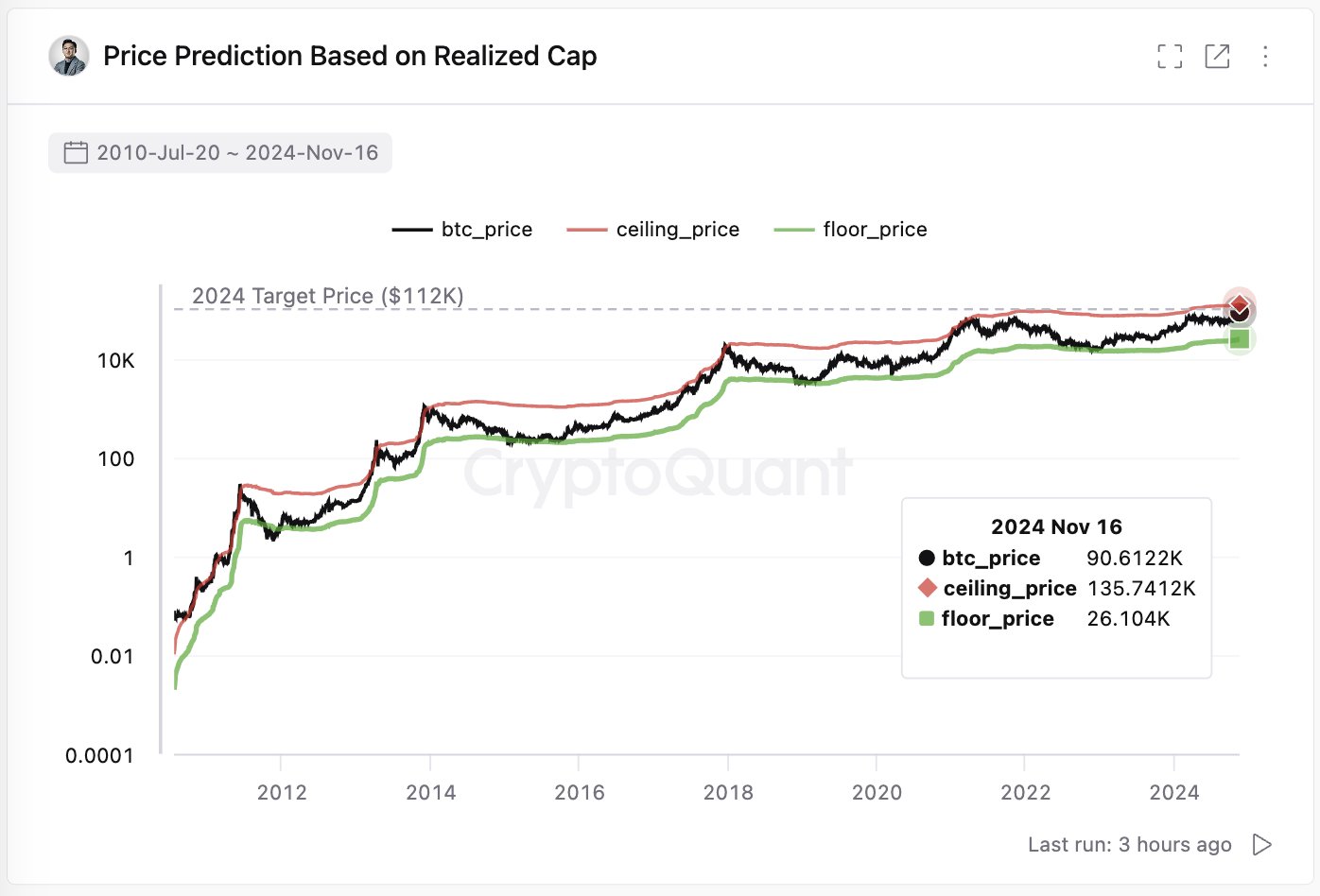

This indicator is called realized price. In the context of the current topic, the realized price itself is not important, but its two multipliers are: 3.9x and 0.75x. Below is a chart shared by Young Ju showing the trend of these two realized price multipliers throughout Bitcoin’s history.

In the chart, the CryptoQuant founder marks 3.9 times the realized price as the “ceiling price” of BTC. Likewise, the 0.75x multiplier represents the “floor price.” Check the trend of indicators during the period past cycle Revealing why analysts choose to do this. It turns out that the asset has typically topped at or just above the 3.9x multiple and has bottomed at or just below the 0.75x multiple.

Currently, the asset’s cap price is around $135,741, while its floor price is $26,104. The current price of Bitcoin is much higher than the latter, but there is also a considerable distance from the former.

This means that with the amount of capital currently invested in cryptocurrencies, it still has room to grow, at least based on the patterns observed historically.

Of course, the cap price won’t necessarily remain where it is now for the remainder of the bull market, as any further new capital inflows into the asset will increase the cap price. But for now, below $136,000 appears to be the upper limit for Bitcoin.

bitcoin price

Bitcoin’s rally has recently hit the pause button as the currency’s value is still around $90,000.