Bitcoin Dominance Sliding Below This Level Could Signal Start Of Altseason, Trading Firm Says

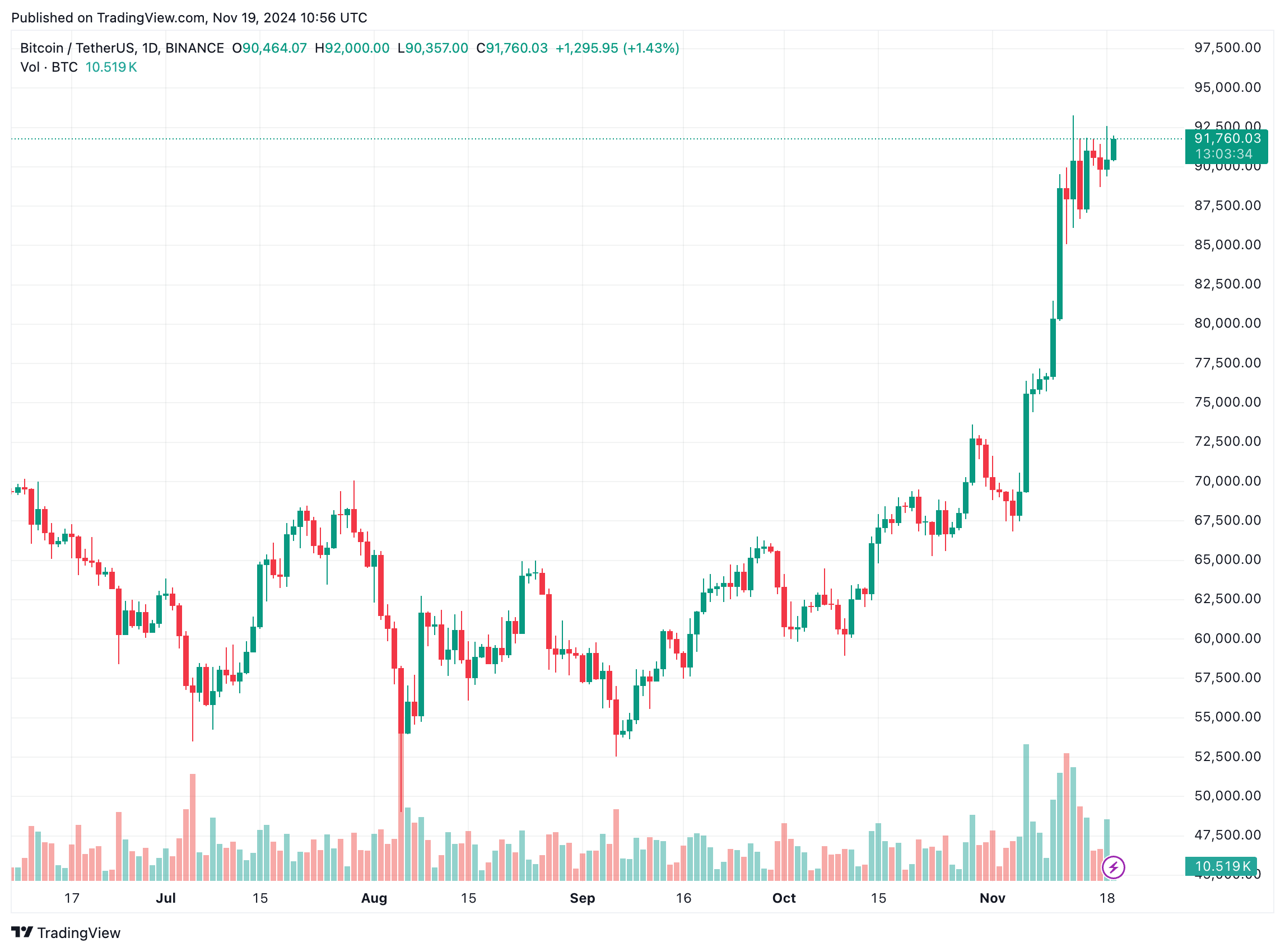

Bitcoin (BTC) continues to maintain its historical price trajectory, trading in the low $90,000 range at the time of writing. However, a trading firm said that Bitcoin dominance (BTC.D) falling below key levels could signal the start of the long-awaited altcoin season.

Rate Cuts, Trump Administration Pushes Cryptocurrencies

In a recent Telegram broadcast, Singaporean trading firm QCP Capital shared Its cryptocurrency market analysis. The firm highlighted Solana’s (SOL) recent performance, noting that it overtook Bitcoin and Ethereum (ETH) over the weekend, surging more than 17% from Friday’s lows.

Related reading

Still, QCP Capital admits that many investors are still hesitant about the prospect of the upcoming altcoin season, given Bitcoin’s steady climb to the psychologically important $100,000 mark. Analysis by Rekt Capital support This sentiment suggests that BTC has only just begun its parabolic phase.

However, QCP Capital predicts that Donald Trump’s victory in the US presidential election and the Federal Reserve’s interest rate cuts could set the stage for a full-blown altcoin season in the coming months.

Trading firm identifies key Bitcoin dominance threshold for Altseason

According to QCP Capital, altcoins have historically outperformed major cryptocurrencies once they have consolidated following a significant rally. The company explained:

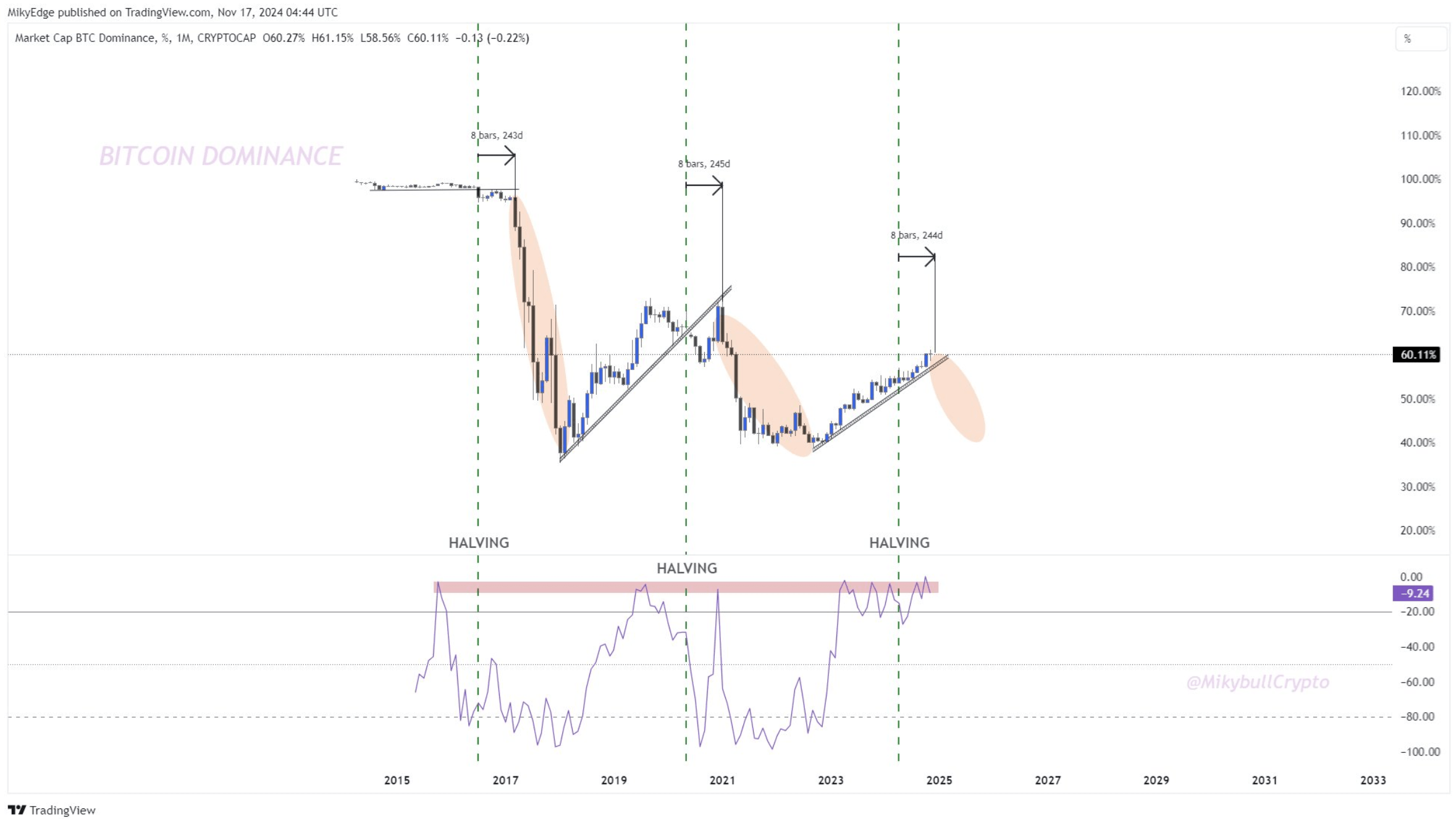

Historically, whenever major currencies have consolidated after a sharp rally, we’ve seen altcoins outperform as profits shift to small-cap stocks. BTC dominance is currently around 60% and may need to drop below around 58% to mark the start of altcoin season.

Currently, BTC.D accounts for 60.10%. The weekly chart shows that Bitcoin’s dominance has been in a steady upward trend since November 2022, when it was hovering at 39.92%. During this two-year period, most altcoins significantly underperformed Bitcoin.

However, altcoins have recently shown signs of recovery, coinciding with the growing likelihood that the Trump administration will support cryptocurrencies. Digital assets such as SOL, Cardano (ADA) and XRP have significantly outperformed BTC over the past few weeks.

Related reading

QCP Capital’s analysis is consistent with that of cryptocurrency analyst @MikybullCrypto, who predicts that BTC.D will begin to decline in December. According to analysts, the copycat season may start in late November and last until March 2025.

Some analysts believe that Bitcoin may continue to rise before showing signs of weakness. For example, Tom Lee, head of research at Fundstrat, recently point out Bitcoin is expected to reach $100,000 by the end of the year.

That said, the recent market cap of altcoins soar A break above a key resistance level suggests that altcoin season may be closer than expected. At press time, BTC was trading at $91,760, unchanged over the past 24 hours.

Featured images from Unsplash, charts from X.com and Tradingview.com