Bitstamp Just ‘Rug Pulled’ The XRP Community: XPMarket CEO

Dr. Artur Kirjakulov, CEO and founder of XPMarket, publicly stated defendant Bitstamp “pulls” at the XRP community. The serious allegation sparked heated debate among industry stakeholders, raising questions about the stability and reliability of Bitstamp’s participation in XRPL-based financial instruments.

Has Bitstamp Rug boosted the XRP community?

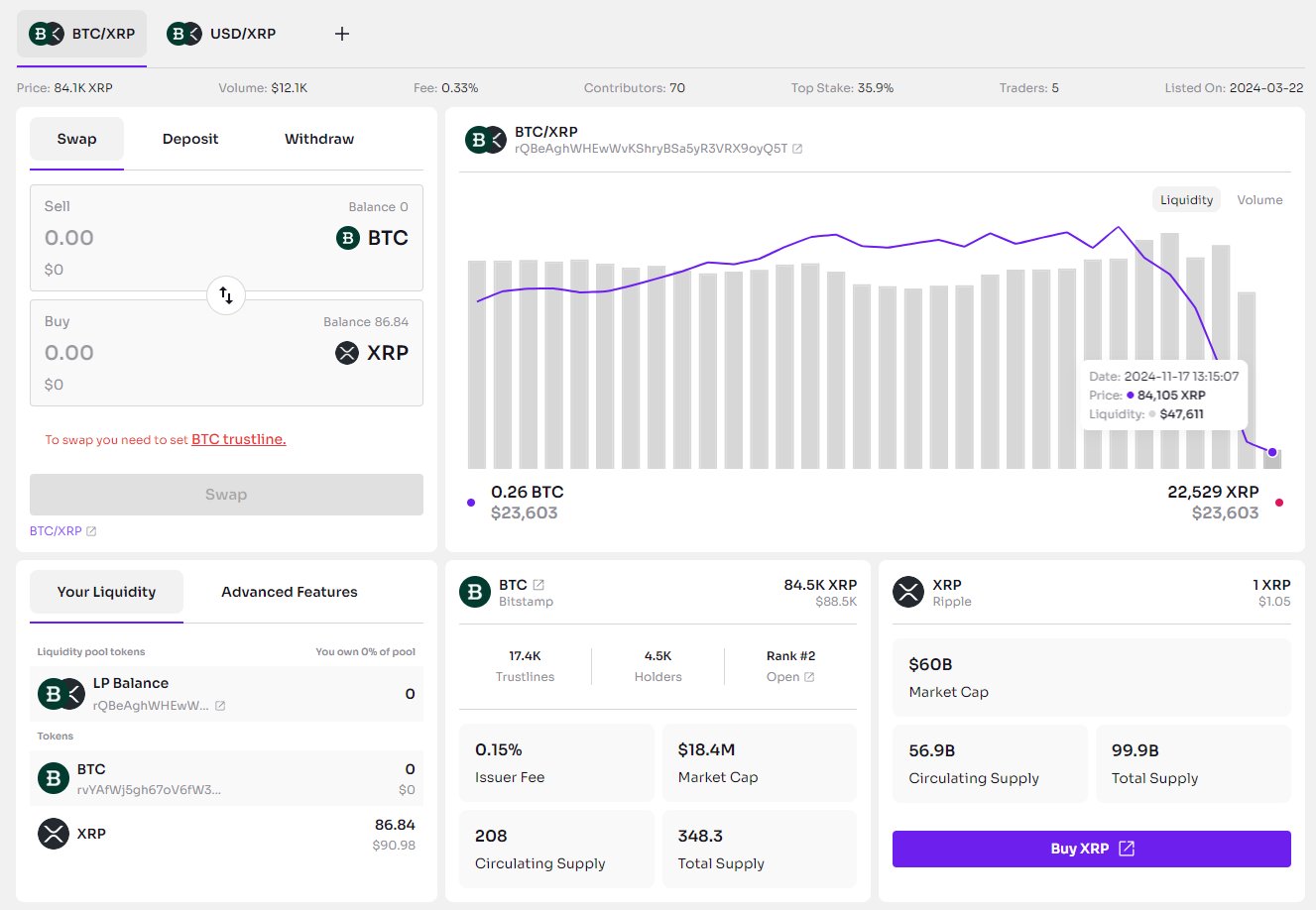

On Sunday, November 17, Dr. Kirjakulov expressed his concerns about Bitstamp’s recent behavior via X. He claimed that “Bitstamp has really kicked off the XRPL community” and asserted that Bitstamp has “withdrawn over 90% of the liquidity from the USD/XRP and BTC/XRP AMM pools,” a move he described as “ This silent” and unannounced move puts the XRPL community in a precarious position.

Kirjakulov said the absence of any official announcement from Bitstamp or RippleX heightened uncertainty about the withdrawal of liquidity, which could lead to “extremely volatile” trading conditions and have a significant impact on the prices of these asset pairs.

Dr. Kirjakulov further emphasized the intricacies of The relationship between Ripple and Bitstampstating that “Ripple has an equity stake in Bitstamp.” This connection suggests that Ripple’s stake in Bitstamp could influence the exchange’s strategic decisions in the XRPL space. The CEO of XPMarket expressed deep concerns about the guarantee of a 1:1 exchange rate for wrapped assets issued by Bitstamp, and drew an analogy to the failure to honor such guarantees in the Stable incident. He emphasized, “How can anyone believe in DeFi on XRPL when the official partners make such a move? The optics are terrible.”

Related reading

These accusations did not go unnoticed within the XRPL community. Eminence CTO and XRPL ambassador Daniel Keller expressed doubts about the veracity of Kirjakulov’s claims. Keller questioned the legitimacy of the account associated with the liquidity pool, saying: “Do we know this is an official Bitstamp account? Looking back at the activation sequence, it was activated through Binance, which would be weird if Bitstamp ran it.”

In this regard, Dr. Kirjakulov insisted that the relevant account is indeed related to Bitstamp. He clarified: “By looking at these accounts, you can see that they are clearly related to Bitstamp because they are also doing market making activities in these tokens. No one else is actually interested in making markets in these tokens because they are Niche and unpopular.”

He further explained that liquidity had been withdrawn from market maker (MM) accounts, reinforcing his assertion that Bitstamp was directly involved. Kirjakulov also dismissed the importance of activating an account, stating: “There is no point in activating an account. I activate my account from exchange multiple times Especially to reduce traceability. “

Related reading

Keller pressed for more concrete evidence to support the claims. He asked: “Can you share some of these affiliate transactions because it would be cool to share if you have looked them up. If you are an exchange that supports LPs, it is very important to activate the account because you want people to know This is your company.

Dr. Kirjakulov responded, highlighting the strength of the circumstantial evidence pointing to Bitstamp, saying: “Indirect evidence? Yes. But this evidence points pretty clearly to Bitstamp because no one else has it except someone affiliated with them The sheer volume of assets they issue is no excuse to ignore them.”

The discussion extended to the topic of Bitstamp’s IOU service. User Michael Nardolillo on X defended Bitstamp, highlighting its regulated status and the redeemability of its IOUs. He argued: “There’s no guarantee that Bitstamp will honor their IOU?! That’s like saying there’s no guarantee that you can withdraw your crypto from the exchange. Bitstamp is highly regulated and IOUs are always redeemable, which is not the same as when trading The assets held are no different.”

This defense was met with skepticism by Kiryakulov, who drew attention to the industry’s past failings. He retorted: “Somewhere FTX Creditors I covered my face a few times. Likewise, Stabilly does not support 1:1 conversion. No source on Bitstamp or even GateHub claims there will be a 1:1 conversion, nor is there any proof of funding. “

To substantiate his defense, Nardolillo shared a screenshot of Bitstamp’s website detailing their IOU services. The screenshot shows that users can transfer value on XRP Ledger through IOUs issued by Bitstamp in exchange for physical assets such as BTC, USD, Euro or ETH.

Dr. Kiryakulov highlights an important omission in this arrangement. He said: “Here’s the problem. This is the only way to do this exchange. Also, it doesn’t mention a 1:1 conversion at all. What if it decouples 50%? They will exchange 1 bUSD (worth 50 cents) into 1 USDT (worth 1 USD)?”

As of press time, the XRP community is waiting for Bitstamp’s official response. XRP is trading at $1.15.

Featured image created using DALL.E, chart from TradingView.com