Bitcoin Miners Sold Over 3,000 BTC In The Past 48 Hours – Consolidation Phase Ahead?

Bitcoin maintained its bullish momentum over the weekend, consolidating its position above the $90,000 mark. This milestone showcases Bitcoin’s resilience as it continues to attract investors on its upward trajectory. The market has been filled with optimism as Bitcoin approaches new highs. However, recent on-chain data suggests a potential pullback may be coming.

Related reading

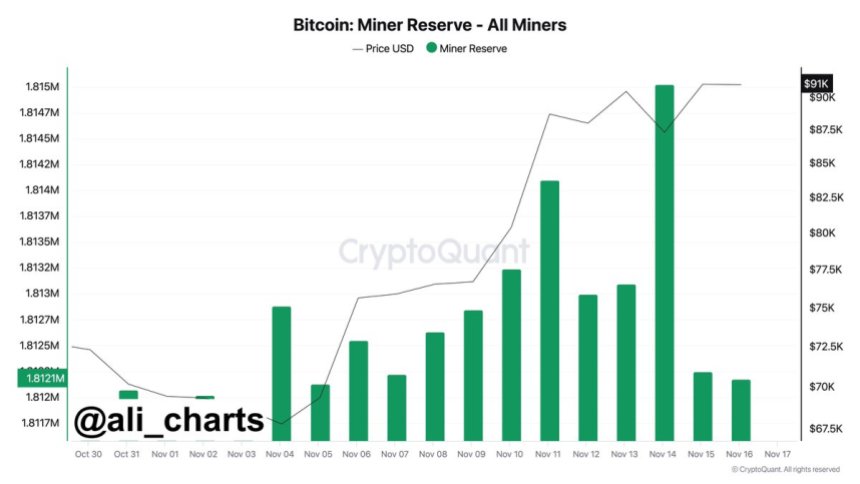

Key data from CryptoQuant shows that Bitcoin miners sold more than 3,000 BTC in the past 48 hours. This wave of miner profit-taking typically heralds a cooling-off phase as it introduces additional supply to the market. While selling activity is not uncommon during periods of price strength, this could result in a short-term consolidation phase below the all-time high of $93,400 set earlier this week.

despite this, Bitcoin’s ability to hold above $90,000 highlights strong underlying demand and strong market sentiment. Investors and analysts are closely watching whether Bitcoin can absorb this selling pressure and maintain its bullish trajectory in the coming days.

Bitcoin looks very strong

Bitcoin’s price action remains strong, breaking all-time highs multiple times over the past 11 days and reaffirming its bullish momentum. However, after such an aggressive rally, the market appears to be entering a period of consolidation as some investors and entities lock in profits.

Cryptocurrency Analyst Ali Martinez Shares Key Figures for X This highlights that Bitcoin miners sold more than 3,000 Bitcoins worth approximately $273 million in the past 48 hours. This selling activity suggests that miners, typically long-term holders, are taking profits from the recent price surge. This move is common during strong bull markets and may indicate that market participants anticipate short-term stabilization or a correction in prices.

While miner selling is a natural part of market dynamics, this continued activity could signal a shift in sentiment. If selling pressure persists, it could push Bitcoin into lower demand areas, providing a potential return opportunity for investors on the sidelines.

Related reading

For now, Bitcoin’s ability to absorb this selling pressure will determine whether the current bullish trend remains intact. A brief consolidation phase can be beneficial and allow the market to establish a stronger foundation for the next move higher. Currently, investors are keeping a close eye on key levels to gauge the potential for continued growth or a deeper correction.

BTC stabilizes above $90,000

After a few days of volatility, Bitcoin is currently trading at $90,600, with the price ranging between an all-time high of $93,483 and a local low of $86,600. The consolidation comes on the heels of aggressive bullish momentum hitting new records, leaving investors and analysts keeping a close eye on what’s next.

Despite the recent cooling off, Bitcoin’s price action remains strong, supported by increased demand and overall bullish sentiment. If Bitcoin can sustain levels above $86,000 in the coming days, a new upward challenge and possibly surpassing its all-time highs seems possible. The market has shown resilience and despite minor profit-taking, new demand continues to emerge.

Related reading

However, there is a risk of further pullbacks. If Bitcoin loses support at $86,000, it may test lower demand levels, looking for strong fundamentals to fuel its next move higher. Key areas of support can provide a basis for fresh buying interest and set the stage for the next bullish phase.

Featured image from Dall-E, chart from TradingView