$800 Million Set For Liquidation If BTC Reclaims This Price

Bitcoin (BTC) has been surging recently, hitting multiple all-time highs (ATH) since Donald Trump’s victory in the 2024 US presidential election. Although the top cryptocurrency has witnessed a minor pullback in the past 24 hours, a rebound to earlier price levels could spell trouble for bears.

Bitcoin Bears May Be in Trouble

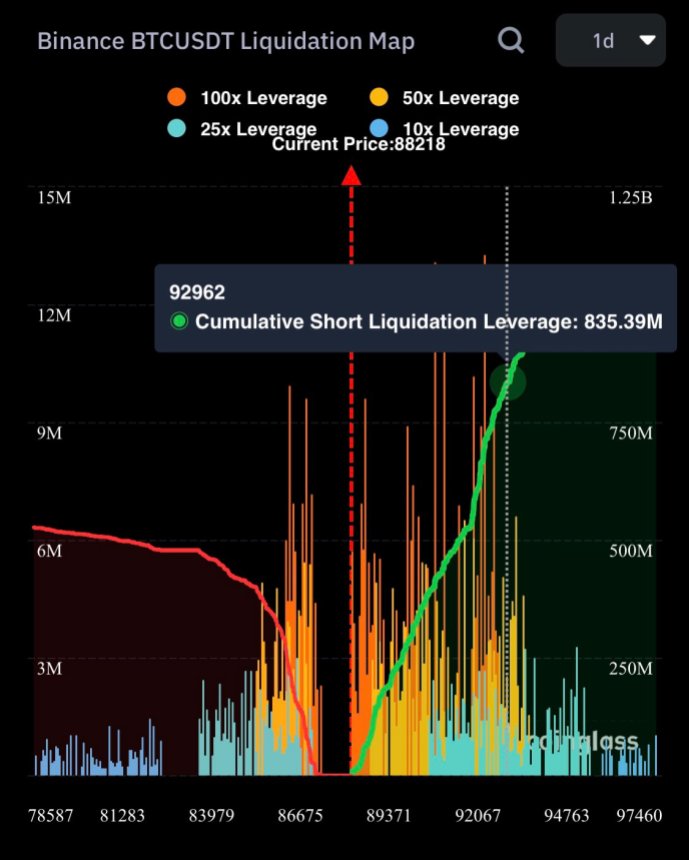

according to analyze Cryptocurrency analyst Ali Martinez said on X that more than $800 million is at risk of liquidation if the flagship digital asset returns to the $93,000 price level. It is worth noting that BTC’s current ATH is $93,477.

Related reading

At the time of writing, BTC is trading at $89,480, down 1.9% in the past 24 hours. On the 4-hour chart, the next significant support level for BTC appears to be near $86,000.

The digital asset has already tested this support level three times and a further drop to this price could send BTC to the next major support level at $81,600. If BTC fails to hold above $81,600, it may drop to $79,700.

While lower BTC prices are good for bears, a return to $93,000 levels could seriously hurt them. The move would bring liquidation risks of more than $800 million and could force bearish traders to capitulate.

data Data from Coinglass shows that more than $508 million worth of contracts were liquidated in the past 24 hours. Among them, US$355 million were long and US$153 million were short.

Recent analysis by renowned cryptocurrency analyst @CryptoKaleo suggestion Martinez’s warning about bears may be justified. According to @CryptoKaleo, BTC may recover to $86,000 before embarking on another rally to reach new highs – possibly over $100,000. The analyst said:

Just drop a little and widen the range and send it over $100,000. Honestly, this is the best case scenario for alt if we can get it somehow. Outperformance will be sought when BTC accumulates around $90,000.

What’s behind the rise in BTC?

Multiple factors contributed to Bitcoin’s historic price action, including the halving earlier this year, the approval of a Bitcoin exchange-traded fund (ETF), and rise Institutional adoption of digital assets.

Related reading

However, Trump’s victory in the 2024 US presidential election – an outcome seen as favorable for cryptocurrencies – became the main catalyst for BTC’s surge. Since Trump’s victory on November 5, BTC has climbed from around $69,000 to a high of $93,000, a gain of more than 30% in just 10 days.

Despite the impressive price rise, experts believe Bitcoin may have room for further growth. For example, a recent research report predict BTC’s bullish momentum is likely to continue until mid-2025, when it is expected to peak.

Additionally, the relatively low level of profit-taking during this bull market may further advance Bitcoin reaches new heights. However, bulls should continue cautious CME has a significant gap near the $78,000 level, which may attract a price correction.

As of this writing, the total cryptocurrency market capitalization is $2.904 trillion, down 3.7% in the past 24 hours. Meanwhile, Bitcoin’s dominance stands at 60.97%, highlighting BTC’s continued strength in the market.

Featured images from Unsplash, charts from X, Coinglass and Tradingview.com